Key Principles of Scalp Trading in the Cryptocurrency Market; Cryptocurrencies are known for their inherent volatility, which presents both risks and opportunities for traders. Despite the potential risks, there are several strategies available to traders seeking profitable returns. Among these strategies, scalp trading, also known as scalping, is often favoured by traders who are comfortable with risk and dedicate significant time to monitoring price movements.

In this article, we will explore the concept of scalp trading in detail, including its mechanics and strategies. Additionally, we will provide valuable scalp trading tips to help you establish a solid foundation for your cryptocurrency trading endeavours. By understanding the principles of scalp trading, you can enhance your trading skills and potentially improve your trading outcomes in the crypto market.

Key Principles of Scalp Trading in the Cryptocurrency Market

What Is Scalp Trading in Cryptocurrency?

Scalp trading in the cryptocurrency market is a short-term trading strategy that involves making quick and frequent trades to profit from small price fluctuations. Traders who employ scalp trading, known as scalpers, aim to take advantage of the market’s volatility and capitalize on small price movements within a short time frame, typically ranging from seconds to minutes.

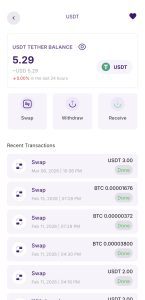

The goal of scalp trading is to accumulate small gains repeatedly throughout the day instead of holding positions for longer periods. Scalpers execute multiple trades, often relying on technical analysis, chart patterns, and market indicators to identify favourable entry and exit points. They aim to capture small profits from the bid-ask spread or slight price discrepancies between different trading platforms.

Scalp trading requires traders to closely monitor the market, react swiftly to price movements, and maintain discipline in executing their trades. It is a highly active and fast-paced trading strategy that requires focus, risk management, and the ability to make quick decisions.

While scalp trading can be potentially lucrative, it also carries risks. Traders must be mindful of transaction costs, market liquidity, and potential price reversals. Developing a solid trading plan, setting clear profit targets and stop-loss levels, and continuously evaluating and adjusting your strategy based on market conditions are essential.

Types of Crypto Scalping Strategies

Price Action Scalping: This strategy focuses on analyzing price movements and patterns without relying heavily on indicators. Traders using price action scalping look for specific chart patterns, such as support and resistance levels, trend lines, and candlestick formations, to identify potential entry and exit points.

Breakout Scalping: Breakout scalping involves identifying breakouts from key levels of support or resistance. Traders wait for a significant price movement beyond these levels and enter trades to capitalize on the momentum. Breakout scalping requires quick decision-making and managing risk in case of false breakouts.

Range Scalping: Range scalping involves trading within a defined range-bound market. Traders identify price ranges where the cryptocurrency’s price repeatedly bounces between support and resistance levels. They enter trades when the price reaches the support level and exit near the resistance level, or vice versa.

Scalping with Indicators: Some traders combine technical indicators, such as moving averages, oscillators, or volume indicators, with their scalping strategy. These indicators provide additional insights into market trends, momentum, and overbought or oversold conditions, helping traders make more informed trading decisions.

Time-Based Scalping: Time-based scalping involves executing trades based on specific time intervals or market sessions. For example, a trader may focus on scalping during the first few minutes of a trading session when volatility tends to be higher. They take advantage of short-term price fluctuations during these time periods.

Arbitrage Scalping: Arbitrage scalping takes advantage of price discrepancies between different cryptocurrency exchanges. Traders quickly buy the cryptocurrency on one exchange at a lower price and sell it on another exchange where the price is higher. This strategy requires fast execution and efficient monitoring of multiple exchanges.

How to Set up a Crypto Scalping Trading Strategy?

If you are new to crypto scalping, don’t hesitate to use this technique. You can follow these simple steps to get started.

Define Your Goals and Risk Tolerance: Determine your trading goals, such as the desired profit targets and the maximum acceptable loss. Understand your risk tolerance level and set appropriate risk management parameters, including position size and stop-loss orders.

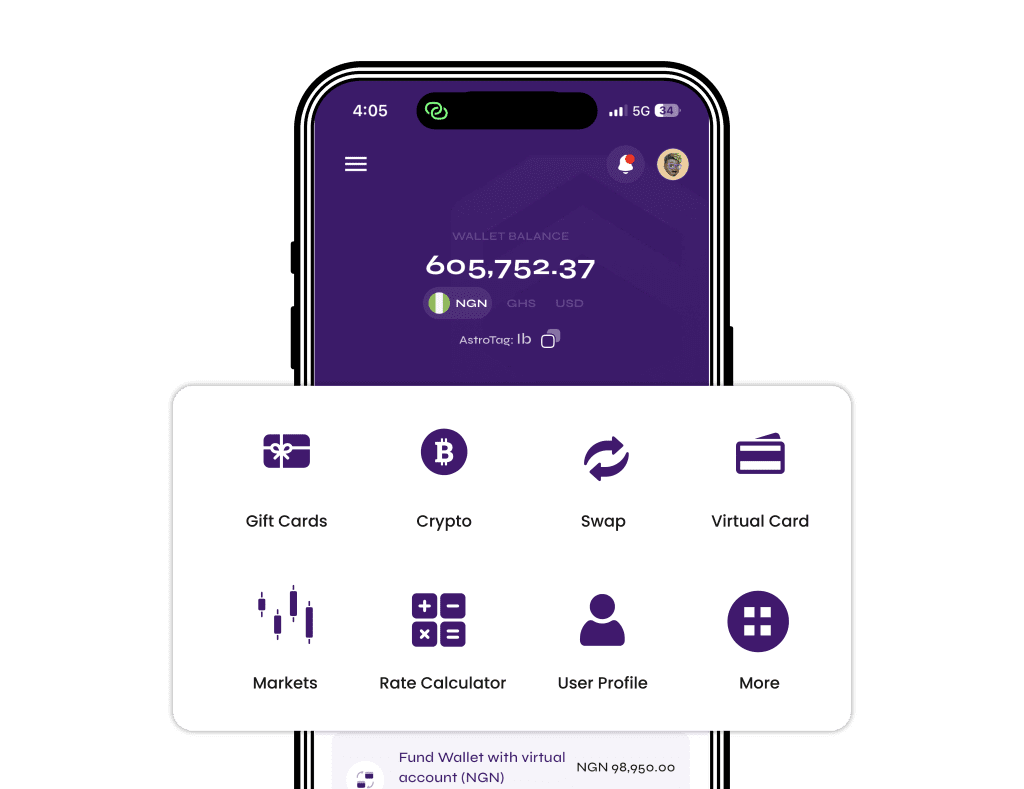

Choose the Right Cryptocurrency Exchange: Select a reputable cryptocurrency exchange with high liquidity, low trading fees, and fast execution. Ensure that the exchange supports the cryptocurrencies you intend to trade.

Choose the trading pairs for scalping: The crypto market offers a wide range of assets consisting of thousands of different cryptocurrencies. These assets vary in terms of their prices, trading volumes, popularity, and market capitalization. When making investment decisions, it is important to consider factors such as asset liquidity and volatility to ensure wise choices.

Identify Scalping Opportunities: Analyze the market to identify potential scalp trading opportunities. Use technical analysis tools like chart patterns, indicators, and price action to identify short-term price movements and volatility.

Set Entry and Exit Criteria: Define clear entry and exit criteria based on your chosen scalping strategy. This may include specific price levels, breakout points, or indicator signals. Determine the duration of your trades and the profit targets you aim to achieve.

Implement Risk Management Measures: Set appropriate stop-loss orders to limit potential losses in case the market moves against your trade. Consider using trailing stops to lock in profits as the price moves in your favour. Calculate the risk-reward ratio for each trade to ensure it aligns with your risk tolerance.

Constantly Monitor the Market: Scalping requires active monitoring of the market, as trades are executed within short time frames. Stay updated on market news, economic events, and cryptocurrency developments that may impact the price. Use real-time market data and trading tools to stay informed and make timely trading decisions.

Also read: Bitcoin Trading Strategies For Nigerian Investors: Tips And Tricks

Best Tools to Scalp Trade Crypto

Successful trades in the cryptocurrency market often rely on using various tools essential for traders. These tools can be categorized into free or paid options, with the paid tools generally offering greater functionality and overall assistance. Here are some of the tools that you can leverage for optimal trading outcomes:

Price Trackers: Utilize price tracking platforms such as CoinMarketCap, CoinGecko, or CoinStats to monitor real-time prices, market trends, trading volumes, and market capitalization of cryptocurrencies.

Portfolio Trackers: Use portfolio tracking tools like Blockfolio, Delta, or CoinTracking to keep track of your cryptocurrency holdings, monitor profits/losses, and view performance metrics.

Advantages and Disadvantages Of Crypto Scalping

Pros:

Quick Profits: Scalping aims to capitalize on short-term price fluctuations, allowing traders to potentially make quick profits from multiple trades throughout the day.

Reduced Exposure: Since scalping involves short holding periods, traders are exposed to market volatility for a shorter duration, which can minimize the impact of unexpected market movements.

Cons:

High Transaction Costs: Frequent trading in scalping can result in increased transaction costs, such as trading fees, spread, and slippage, which can eat into profits, especially with smaller price movements.

Time-Intensive: Successful scalping requires continuous monitoring of price movements and market conditions, requiring significant time and attention throughout the trading session.