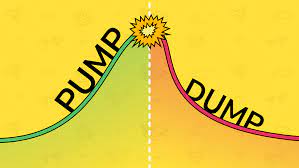

Protecting Yourself from Pump-and-Dump Schemes; The cryptocurrency market has unfortunately become a breeding ground for various investment scams, and pump-and-dump crypto schemes are prevalent among them. These schemes revolve around fraudulent practices where individuals or groups manipulate the price of a particular asset, typically a cryptocurrency, by disseminating misleading information and generating hype around it. Their intention is to artificially inflate the price, enticing others to invest. Once the price reaches a desired level, the perpetrators swiftly sell their holdings, reaping significant profits. Regrettably, this leaves unsuspecting investors with worthless assets and substantial financial losses. It is essential for individuals to exercise caution and remain vigilant in order to protect themselves from such deceitful practices.

Recognizing and avoiding pump-and-dump crypto schemes is crucial for safeguarding oneself against investment scams. These schemes have the potential to inflict substantial financial losses, underscoring the importance of investors being well-informed about the warning signs. In the subsequent sections, we will delve into the mechanics of these schemes, highlight indicators to be vigilant for, and provide guidance on avoiding falling prey to such deceptive practices.

Tips to Protecting Yourself from Pump-and-Dump Schemes

Signs of a Pump-and-Dump Crypto

Recognizing the signs of a pump-and-dump crypto scheme is crucial to avoid falling victim to investment scams. Here are some key indicators to be aware of:

1. Sudden and significant price spikes: Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency within a short period. If you observe an unexplained and dramatic price surge followed by a rapid decline, it could be a red flag.

2. Unsubstantiated hype and promotion: These schemes heavily rely on creating a buzz around the cryptocurrency through misleading or exaggerated claims. Exercise caution if you encounter exaggerated promises of extraordinary returns without credible evidence or a clear value proposition.

3. Unreliable information sources: Pump-and-dump schemes often rely on spreading false or manipulated information to manipulate investor sentiment. Be cautious of unreliable sources, such as social media accounts, forums, or anonymous individuals, who promote cryptocurrency without providing verifiable facts or trustworthy analysis.

4. Lack of fundamental value: Pump-and-dump coins usually lack a solid foundation or a legitimate use case. They may not have a clear technology, practical application, or a strong development team. Scrutinize the project’s whitepaper and website to assess the credibility and feasibility of the cryptocurrency.

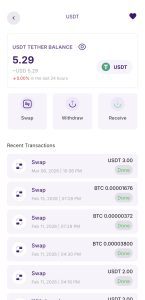

5. Limited trading volume and liquidity: Pump-and-dump schemes typically target cryptocurrencies with low trading volume and liquidity. This allows the manipulators to exert more control over the price movement. Be wary of investing in illiquid coins that can be easily manipulated.

6. High-pressure tactics and time-limited offers: Fraudsters behind pump-and-dump schemes may employ aggressive marketing tactics, urging investors to make immediate decisions or create a fear of missing out (FOMO). They may introduce time-limited offers or bonuses to entice impulsive investments.

Popular Examples Of Pump And Dump Scams

Bitconnect: Bitconnect was a prominent example of a pump and dump scheme. It operated as a lending and exchange platform with its own cryptocurrency. The project attracted investors by promising high returns, but it eventually collapsed in 2018 after facing regulatory scrutiny and accusations of operating as a Ponzi scheme.

Centra Tech: Centra Tech raised over $25 million through an initial coin offering (ICO) by claiming to offer a debit card allowing users to spend cryptocurrencies. However, the project turned out to be a fraudulent scheme, and its founders were charged with securities fraud and wire fraud by the U.S. Securities and Exchange Commission (SEC).

GAW Miners and ZenMiner: GAW Miners and ZenMiner were companies involved in selling mining hardware and cloud mining contracts. They were accused of conducting a Ponzi scheme, defrauding investors of millions of dollars. The founder, Josh Garza, pleaded guilty to wire fraud in 2017.

Also read: How To Avoid Bitcoin Scams and Frauds: A Guide For Investors

How to Avoid Falling for a Pump-and-Dump Scheme

Falling for a pump-and-dump scheme can lead to significant financial losses. Here are some tips to help you avoid becoming a victim:

1. Do thorough research: Before investing in any cryptocurrency, conduct comprehensive research. Look into the project’s background, team members, technology, and overall credibility. Verify the information provided and assess if the cryptocurrency has a genuine use case and long-term potential.

2. Be skeptical of unrealistic promises: Be cautious of cryptocurrencies that promise extraordinarily high returns within a short period. It likely is if an investment opportunity sounds too good to be true. Exercise critical thinking and question the legitimacy of exaggerated claims.

3. Assess the trading volume and liquidity: Check the trading volume and liquidity of the cryptocurrency. Pump-and-dump schemes often target illiquid coins with low trading volumes, making it easier for manipulators to control the price. Opt for cryptocurrencies with substantial trading volume and liquidity, which are less susceptible to market manipulation.

4. Stay informed about market trends: Keep yourself updated with the latest news and developments in the cryptocurrency market. Stay informed about any regulatory actions, scam alerts, or warning signs associated with certain projects. Trusted sources such as reputable news outlets, official project announcements, and respected community members can provide valuable insights.

5. Avoid investing based on FOMO: Beware of making impulsive investment decisions driven by the fear of missing out (FOMO). Pump-and-dump schemes often exploit FOMO to attract investors. Take the time to assess the fundamentals and potential risks before investing in any cryptocurrency.

6. Use reputable exchanges: Stick to well-known and reputable cryptocurrency exchanges when buying or trading cryptocurrencies. Established exchanges typically have stricter listing criteria and conduct due diligence on their list projects, reducing the likelihood of pump-and-dump schemes being present.

7. Be cautious of anonymous projects and teams: Exercise caution when dealing with cryptocurrencies that have anonymous teams or lack transparency. Legitimate projects usually have a visible and credible team with verifiable experience and a track record in the field. Anonymity can be a red flag indicating potential fraudulent intentions.

8. Seek advice from trusted sources: Consult with experienced investors, cryptocurrency communities, and experts with a solid market understanding. They can provide guidance and help you navigate potential risks.

Conclusion

If you are new to cryptocurrency, sticking with what you know is safer.

New cryptocurrency projects always carry that fresh appeal of financial freedom, and it feels good to picture yourself holding the new Bitcoin or Ethereum. But unless you have in-depth knowledge about the DEX market or have tons of idle money to throw away, it is best to stay with coins and projects you trust.

Popular exchanges often list new coins and only the ones they trust. Keep up with the news; eventually, you might find something you like.