Key Indicators to Identify the Start of an Altcoin Season; The term “altcoin season” is not merely a flashy expression meant to impress your fellow cryptocurrency enthusiasts. It holds significant relevance for traders seeking to leverage market opportunities. Discover the key indicators to identify an altcoin season and learn how to incorporate altcoins into your portfolio to aid diversification.

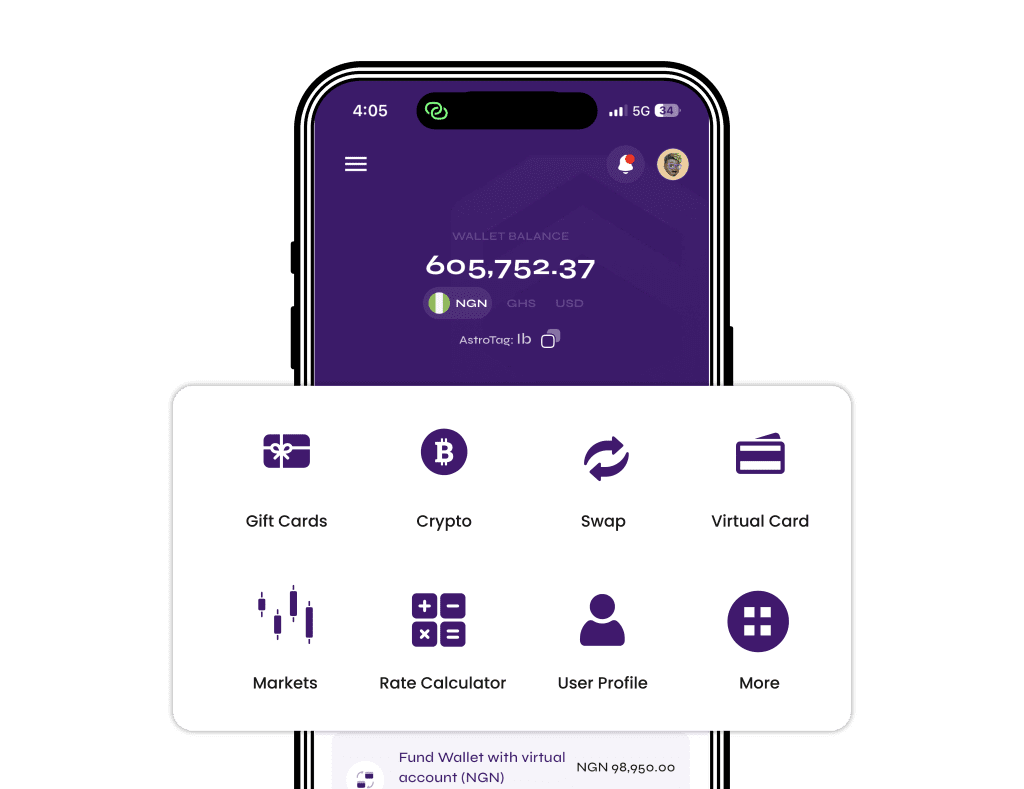

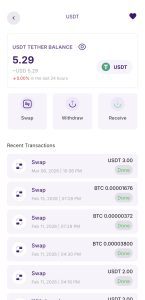

Astro Africa is a modern cryptocurrency exchange platform. Offering an unmatched financial product suite with hundreds of altcoins, the platform is trusted by thousands of cryptocurrency traders in Africa. Start trading your cryptocurrency by registering for an Astro Africa account today.

What Is an Altcoin Season?

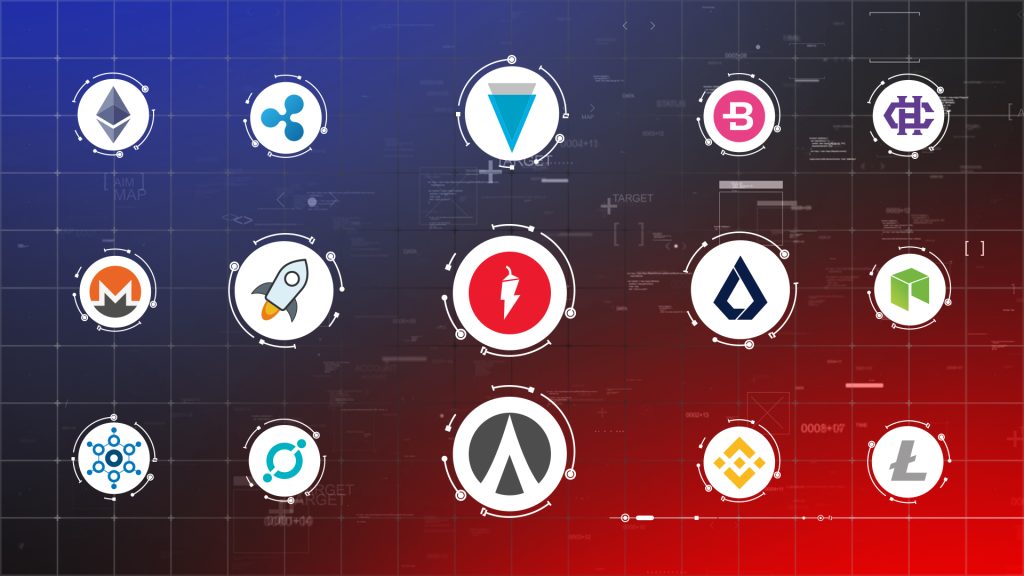

An altcoin season refers to a period in the cryptocurrency market when alternative coins, or altcoins, experience significant price growth and outperform Bitcoin, the dominant cryptocurrency. During an altcoin season, there is a surge in investor interest and trading volume in altcoins, leading to substantial price increases across a wide range of cryptocurrencies other than Bitcoin.

Altcoin seasons are characterized by a shift in market sentiment, with investors seeking higher returns and diversification beyond Bitcoin. This phenomenon often occurs during bullish market cycles when overall market confidence and risk appetite are high. Altcoins, encompassing cryptocurrencies other than Bitcoin, may include Ethereum, Ripple, Litecoin, and many others.

During an altcoin season, the prices of altcoins can skyrocket, sometimes even outperforming Bitcoin by a significant margin. This trend can be attributed to factors such as new product launches, technological advancements, increased adoption, positive news sentiment, or investor speculation.

It’s important to note that altcoin seasons are not guaranteed and can be unpredictable. They can occur intermittently and vary in duration and intensity. Traders and investors closely monitor market indicators, such as altcoin dominance, trading volumes, and price movements, to identify and capitalize on potential altcoin seasons.

Participating in an altcoin season requires careful research and analysis to identify promising projects with strong fundamentals and growth potential. It’s crucial to consider factors like project team, technology, market demand, community support, and overall market conditions before adding altcoins to your portfolio.

Binance, one of the leading cryptocurrency exchanges, provides a platform for traders and investors to access a wide range of altcoins during altcoin seasons. By leveraging Binance’s trading features and tools, you can effectively take advantage of price movements, execute trades, and manage your altcoin investments.

Also Read: Tales from the Crypt: Infamous Shitcoin Scams and Frauds

3 Key Indicators to Identify the Start of an Altcoin Season

Given the inherent volatility of the cryptocurrency market, it is important to note that there is no foolproof indicator to predict the onset of an altcoin season. However, based on historical data, certain indicators may potentially serve as signals for an impending altcoin season.

When Bitcoin is enjoying a bull market run

During previous years, the conclusion of Bitcoin’s bull market has frequently coincided with a notable performance of altcoins. This occurrence can be attributed to new investors entering the market and showing interest in altcoins due to their comparatively lower prices when compared to Bitcoin. As a result, the growth potential of altcoins becomes more enticing, leading to their increased popularity and positive performance.

When there are new blockchain trends

The influence of blockchain trends has played a significant role in the performance of certain altcoins. A prime example is the rise of DeFi in 2020, which led to the growth of DeFi-focused altcoins that continue to flourish. Similarly, the emergence of the metaverse trend attracted interest from gamers, enthusiasts, and communities beyond the crypto sphere. Given that altcoins play a crucial role in accessing the metaverse, it comes as no surprise that their popularity surged alongside the metaverse’s global impact. As new milestones and trends continue to emerge in the blockchain space, the excitement surrounding altcoins associated with these developments is expected to follow suit.

Market sentiment

The sentiment prevailing in the market, which represents the collective mindset of traders and investors, is a key determinant of altcoin season. During this period, traders seeking rapid gains may opt to sell their Bitcoin holdings and shift their focus to alternative cryptocurrencies if interest in Bitcoin wanes. Moreover, the relatively high price of Bitcoin can deter potential cryptocurrency buyers, prompting them to explore alternative coins as more affordable options.

The rise of a specific meme coin and its subsequent buzz can spark positive sentiment and excitement among investors. This shared enthusiasm can result in coordinated buying efforts, causing the prices of various meme coins to surge simultaneously.

How To Identify Altcoin Season

Recognising an altcoin season is vital for traders aiming to seize the opportunities presented by the cryptocurrency market. Although identifying it may pose challenges at times, there are several indicators and metrics that can assist in discerning this phenomenon. By closely monitoring these factors, traders can increase their chances of identifying and capitalising on an altcoin season.

Altcoin season index

“The Altcoin Season Index is defined as the amount of the top 50 altcoins that have a 90-day return of investment (ROI) greater than Bitcoin, divided by the amount of altcoins used in the index (50 in this case), and multiplying the result by 100.“

Certain market analysis platforms offer altcoin season indices that monitor the performance of a selection of altcoins in relation to Bitcoin. These indices provide traders with a comprehensive view of market dynamics, enabling them to gauge the intensity of an altcoin season. By referring to these indices, traders can gain valuable insights and determine whether the altcoin season is currently in full swing.

Market capitalisation:

Keeping a close eye on the market capitalisation of altcoins can also offer valuable insights into the altcoin season. This period is characterised by a substantial increase in the total market capitalisation of altcoins, signalling a change in investor sentiment and a heightened demand for alternative cryptocurrencies. Observing the performance of top altcoins like ETH, SOL, DOGE, among others, can indicate a shift in interest away from BTC towards these alternative digital assets.