It’s 2024 and we can no longer say crypto trading is a novel idea. Crypto trading has become increasingly popular with many investors seeking to make a profit despite the market’s volatility. If you are a novice and you intend to make profits like your expert colleagues, it is essential that you have a solid understanding of some basic crypto trading strategies.

With these strategies, you can easily navigate the crypto market come bull or bear market. However, it is quite essential to remind traders that selling and buying crypto carries inherent risks, and learning these strategies doesn’t confer full immunity from losses. Hence, traders must learn to carry out continuous thorough research.

Here, we explore ten crypto trading strategies that can help you navigate the market effectively.

Buy and hold

“Buy and hold” in the crypto sphere is also called “HODL”. HODL is the misspelling of the word “hold.” It means purchasing a cryptocurrency when it is at a low price and waiting for its value to increase to make profits. It is a long-term approach to crypto trading and has proven effective over the years. During the wait period, the value of the crypto asset might undergo fluctuations but it shouldn’t discourage you. Set a goal for the cryptocurrency and sell off the profits immediately after it is reached.

Day trading

Day trading involves buying and selling crypto or entering and exiting a position in the market on the same day within trading hours. The entire purpose of day trading is to profit from significant but tiny movements in the crypto market. The prices of cryptocurrencies are volatile, so day trading can be pretty profitable.

Swing trading

Swing trading is a more extensive version of day trading. In swing trading, crypto traders hold positions for an extended period, typically a few days or weeks to capitalize on medium-term price movements. To be a swing trader, you must be able to form trading strategies using fundamental and technical trading indicators. Swing trading has an advantage over day trading because it gives traders enough time to keep track of a crypto asset’s price and make wise investment decisions.

Scalping

Scalping is a high-frequency trading technique that involves entering numerous trades in a short period by taking advantage of small price movements. When scalping, you are expected to make several trades in a day. Scalping profits are not a lot but when accumulated over time can amount to something huge. It involves a lot of patience since you are expected to take small profits.

Read also: Key principles of scalp trading in the cryptocurrency market

Range trading

Range trading involves a lot of research because traders must identify a range in which a cryptocurrency is trading and open a trade based on the expectation that the price will bounce off the upper or lower end of the range. In this strategy, support marks entry points, preferably with confirmation from other indicators. Resistance marks exit points. Typically, crypto assets trade sideways for an extended period, leaving no room for big gains. However, these range-bound coins and tokens still provide profit opportunities.

Breakout trading

Breakout trading involves buying cryptocurrency when the price breaks through an established resistance level. It also involves selling a cryptocurrency when it breaks through a support level. In breakout trading, you’re looking for assets ready to increase in price, buying when your indicators say go, and exploiting the chart.

Trend following

If you have been paying attention, you would have observed that the value of crypto sometimes follows a particular trend. In 2021, Dogecoin rose to fame after celebrities like Elon Musk promoted the coin. It soon became known as “the people’s cryptocurrency.” Within the period of its fame, there was a lot of buzz about the coin on social media which led to an increase in its price from $0.00268 to its all-time high of $0.7316. If you witnessed the rise of Dogecoin, then you witnessed “trend following” at its finest.

Mean reversion

Mean reversion is based on the idea that prices tend to revert to their historical value. This strategy involves buying a cryptocurrency when prices are low and selling when prices are high.

News based trading

There are news events that can alter the market and you must watch out for such news. For example, if a government announces plans to legalize and regulate crypto trading, it could lead to a surge in demand and prices. The price of bitcoin increased by 20% after the US SEC approved a Bitcoin ETF.

Technical analysis

Technical analysis involves using live trading charts and technical indicators to identify patterns and predict price movement. This way, you can always make informed trading decisions.

Each strategy is riddled with its unique benefits and risks. A bonus strategy is also learning how to pick your poison and knowing when to give up. When you have a firm grasp on these strategies and develop a trading plan tailored to your goals and risk, you will be able to circumvent the hurdles of the crypto trading market with minimal stress.

Trade crypto on a reliable trading platform

About 40% of your success as a crypto trader depends on the platform you choose. While using any of the trading strategies discussed above, it is important that you choose a good trading platform.

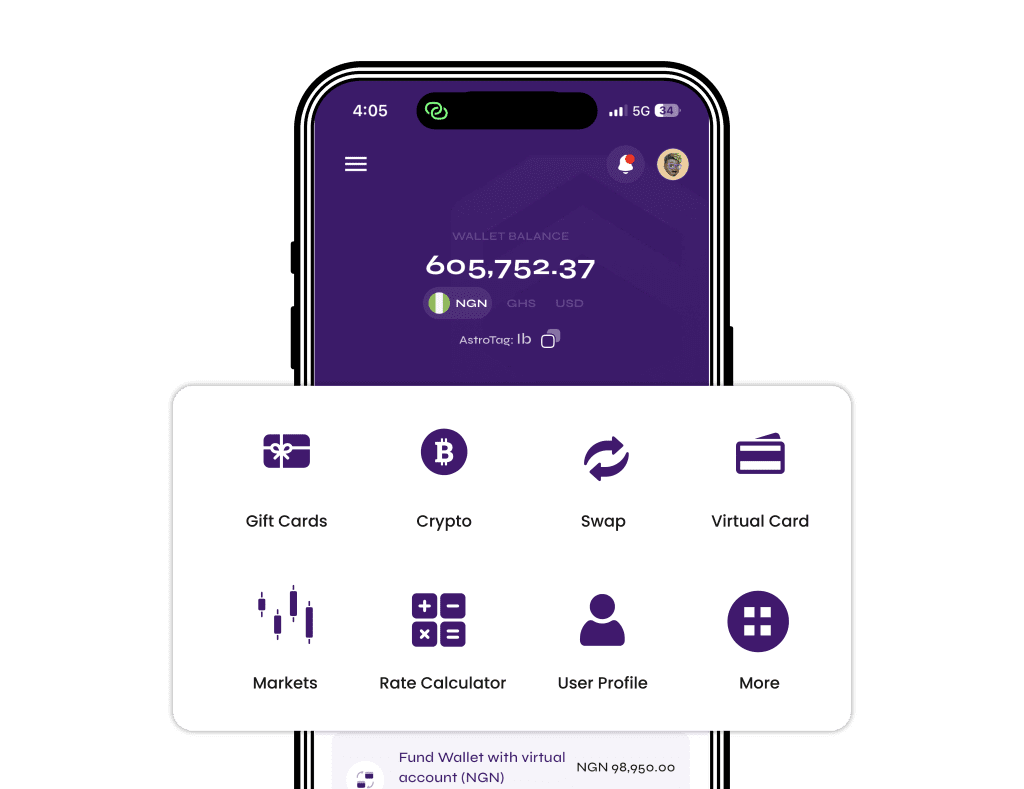

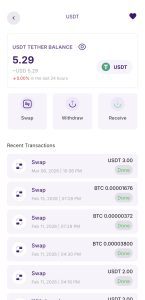

In Ghana, there are several trading platforms but Astro Africa has proven over the years to be one of the best. Astro Africa is safe, dependable, and easy to use. It allows you to trade fast and make high profits with first-rate customer service.

You can trade Bitcoin, Ethereum, Litecoin, and Dogecoin on Astro Africa for money and get paid instantly. Visit the Astro Africa website to create an account and start selling crypto for Ghana cedis.