As a crypto investor, you’ve likely come across the Crypto Fear and Greed Index online or in the news. This index is a tool designed to measure the market sentiment of cryptocurrency at any given moment.

Understanding how the index works, what it signifies, and what it reveals about the market is crucial. With this knowledge at your disposal, you can better determine whether it is wise to incorporate the index into your investment decisions.

What is the crypto fear and greed index?

The index produces a single value ranging from 1 to 100. A value of 1 signifies extreme fear in the crypto market, indicating widespread selling. Conversely, a value of 100 represents extreme greed, indicating heavy buying activity.

Typically, an index value of 1 is seen as a buying opportunity. This is because “extreme fear” suggests that many people are hesitant to buy, leading to potentially lower prices as they avoid purchasing or sell off their holdings out of concern that the cryptocurrency will lose value.

How is the fear and greed index calculated?

The crypto fear and greed index are calculated based on some certain parameters that may include the following.

- Volatility: Volatility represents 25% of the index value. Hence, Higher volatility is considered fearful and increases the final output. The index compares volatility and max drawdowns (a drawdown is a decline in value) against the 30-day and 90-day average volatility and drawdown numbers.

- Momentum/volume: Momentum/volume represents 25% of the index value. The index measures the current momentum and volume of the crypto market. Again, against the 30-day and 90-day averages. High volume and momentum are seen as negative metrics and increase the final index output.

- Social Media: Social media represents 15% of the index value. The index tracks the mentions and hashtags for the particular crypto and compares them to historical averages. Higher mentions and hashtags are interpreted as increased market involvement and lead to an increase in the final index output.

- Surveys: Surveys represent 15% of the index value. The index conducts extensive market-wide surveys on a weekly basis, typically gathering feedback from 2,000-3,000 participants per survey. When survey results show heightened enthusiasm, the index tends to rise, indicating prevailing market greed.

- Dominance: Dominance constitutes 10% of the index’s value, measuring the crypto market’s dominance overall. According to the index, higher crypto dominance correlates with greater market fear. When alternative coins gain market share, it indicates market courage rather than fear. Conversely, lower crypto dominance suggests increasing market greed.

- Trends: Trends represent 10% of the index value. The index includes Google trend numbers in the final value. The higher the search interest of cryptocurrency becomes; the higher amount of greed is seen in the market.

Read Also: Trading strategies to guide your crypto investments

What to consider before using the crypto fear and greed index

While the Fear and Greed Index offers valuable insights into the current state of crypto markets, it should not be considered completely reliable. Therefore, crypto traders should consider the following questions based on their financial goals and objectives before relying on the index.

- Am I a trader or a long-term investor? Short-term traders may benefit greatly from the fear and greed index. However, long-term investors might have to weigh their options carefully because actively trading might result in you missing major rallies and ultimately decreasing your total return.

- What is my tax strategy regarding cryptocurrency? If you’re a day or swing trader who makes trading decisions based on technical indicators like the Fear and Greed Index, you’re likely to face higher exposure to short-term capital gains taxes. It’s essential to consider this factor carefully when making your trading decisions.

- Am I a fundamental or technical trader? The Fear and Greed Index serves purely as a technical indicator and does not incorporate any fundamental factors of cryptocurrency into its calculations. If your cryptocurrency investment strategy is based on macroeconomic factors, the Fear and Greed Index may be considered irrelevant to your investment strategy.

Is the greed and fear index reliable?

Like everything crypto-related, traders have also raised eyebrows concerning the Fear and Greed Index. Over the years, the Fear and Greed Index has exploited numerical scales to reflect investors’ sentiment. The index’s precision in predicting price movements heavily relies on how investors react to its data. Therefore, emotions of fear and greed exhibit a strong correlation with price fluctuations.

Historical data indicates that the Fear and Greed Index tends to decrease (indicating fear) with decline in asset value and increase with asset value appreciation. This direct relationship can vary, yet it does not necessarily indicate the index’s accuracy in predicting crypto asset values. It’s crucial to distinguish between market sentiments and the actual value of crypto assets when evaluating the reliability of the Fear and Greed Index.

Buy and sell Cryptocurrency on Astro Africa for the best rates

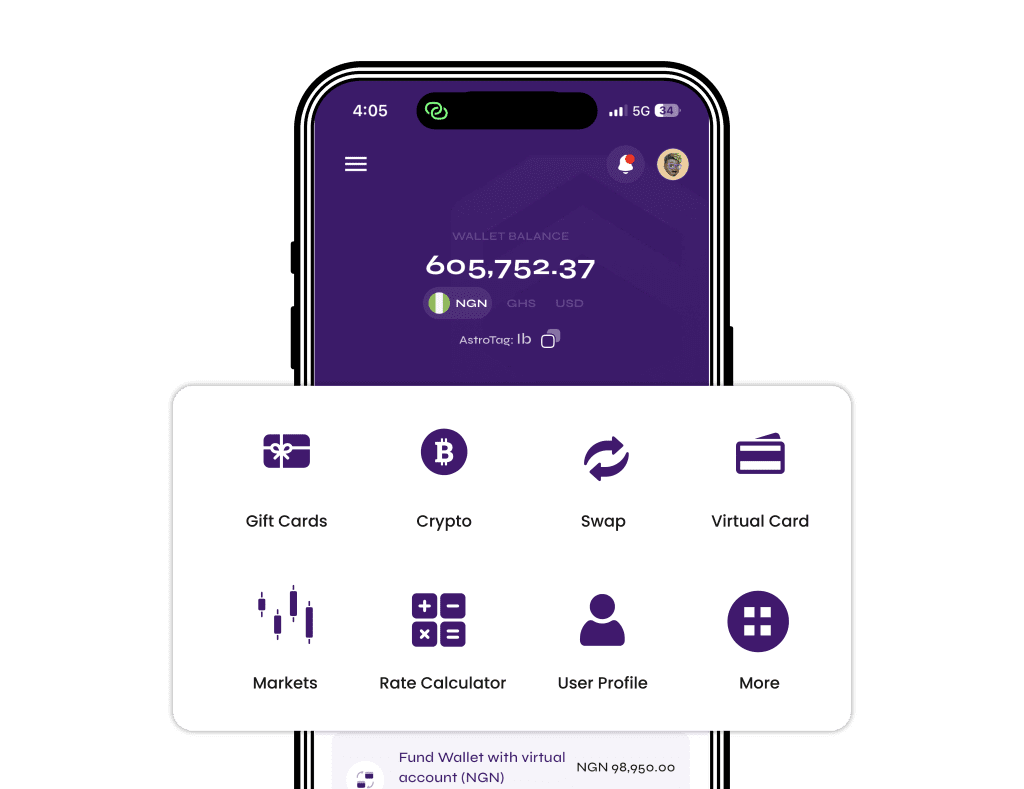

If you’re in Ghana and seeking a platform to convert your cryptocurrencies into cash, Astro Africa is your go-to solution. Recognized as one of Ghana’s premier digital assets platforms, Astro Africa facilitates the buying and selling of gift cards and cryptocurrencies with ease. The platform offers a wide range of features designed to streamline and accelerate transactions.

Astro Africa ensures that all cryptocurrencies are traded at optimal rates, allowing you to maximize your profits. With its robust security measures and dedicated customer service, you can be rest assured that your assets are well protected. To get started, create an account via the Astro Africa website or mobile apps.