Bitcoin options are financial contracts that give the buyer the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before or on a specific expiration date. They are traded on both traditional derivatives exchanges and specialized crypto trading platforms. They are popular among advanced crypto traders who seek to leverage their positions or hedge against market volatility.

If are a new crypto trader and you have been wondering about how to trade bitcoin options, this article is for you. Find the right platform can be quite difficult considering the fact that you are new to the market. However, there are few features you must look out for in your platform of your choice. Your platform of choice must offer enough liquidity and a high level of security.

In this article, we have compiled a guide containing everything that an option trader should know.

How to trade Bitcoin options

To trade Bitcoin option, it is important that you are aware of your risk threshold. You must also have a firm grasp of options trading, Bitcoin’s volatility, and risk management strategies. Here are some step-by-step guides to educate you on how to trade Bitcoin options.

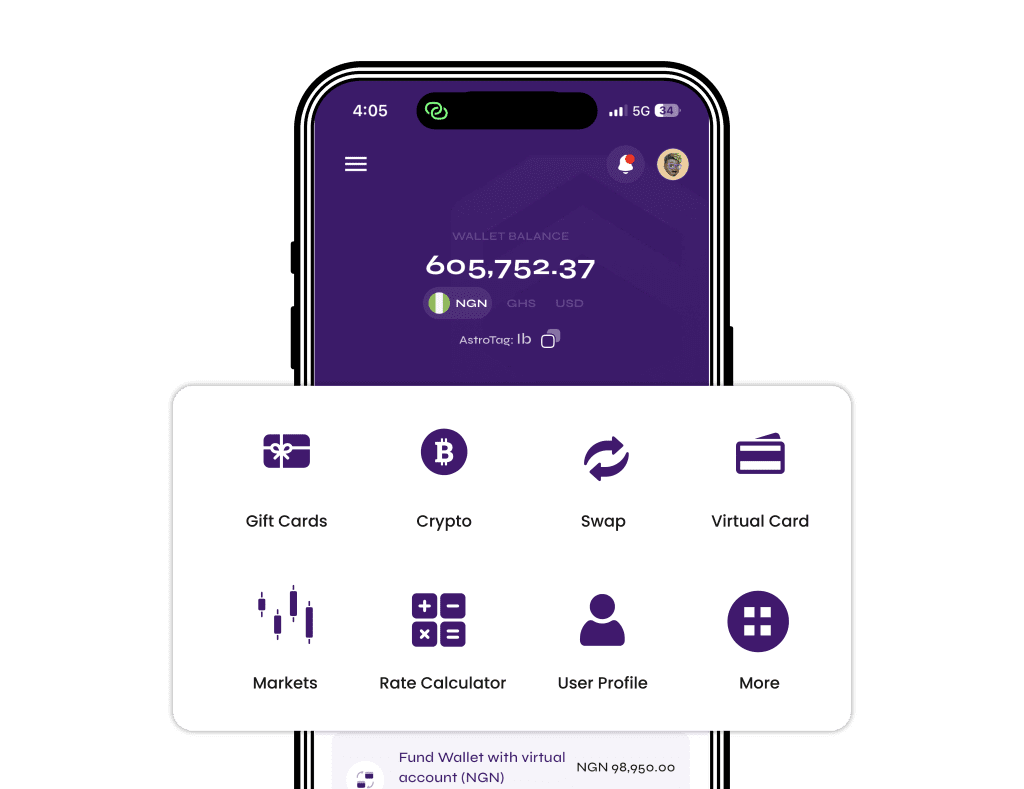

Step 1: Choose a reliable crypto exchange platform

The number of crypto exchange platforms are on the rise everyday but not all of them offer Bitcoin options. Hence, you must carefully research trading platforms that offers options trading before making your decision.

Step 2: Credit your trading account

Deposit funds in your trading account using whichever currency the exchange platform supports. It is usually U.S. dollars. Depending on the platform, you can also deposit cryptocurrency in your exchange account.

Step 3: Practice trading options using a demo account

If you’re new to options trading, it’s advisable to create a demo account to test the waters. The exchange platform you chose should offer a demo trading account, allowing you to trade Bitcoin options without risking real capital. This way, you can gain confidence and familiarity with the process.

Read Also: Selling Bitcoin in Ghana at the best rates

Step 4: Research the Bitcoin Market

Understand the factors influencing Bitcoin’s price to determine the best options trading strategy for the cryptocurrency that aligns with your risk and return preferences. The more you explore the Bitcoin market and Bitcoin options, the higher your chances of trading options profitably.

Step 5: Place Your First Bitcoin Options Trade

If you followed the last four steps, then you should be more than confident to place your first options trade.

Benefits of trading Bitcoin options

There are several benefits of trading Bitcoin options and they are;

Hedging: Options can be used to protect crypto holdings against adverse price movements, acting as a form of insurance.

Leverage: With options trading, traders can easily control a large position on the market with small capital.

Diversification: Bitcoin options expands crypto trading portfolio by providing an additional asset class for diversification within a broader crypto trading portfolio.

Potential for high returns: Depending on the strategy used, options can offer the potential for substantial returns.

Flexibility: Traders can use options for a variety of strategies, from simple to complex, depending on their market view.

Defined risk: Bitcoin options allows traders to take controlled risks since the maximum loss is limited to the premium paid.

Strategic alternatives: With options trading, traders can benefit from any market condition, be it bullish or bearish.

Premium collection: When traders sell an option, they are offered a premium in exchange for taking on the obligation of the option contract.

Risks of trading Bitcoin options

Understanding these risks is crucial before engaging in crypto options trading. You should only ever invest what you can comfortably afford to.

Complexity: Trading options can be quite complex especially if you are new to the venture.

Potential for loss: The premium paid for it is entirely lost, if an option expires out-of-the-money.

Leverage risk: Leverage can amplify gains and losses in the same vain. So you must be entirely sure you want to engage in options trading before investing.

Liquidity issues: Some crypto options may have low trading volumes, resulting in wider bid-ask spreads and making them more difficult to buy or sell.

Regulatory and platform risks: Options have an expiration date, and their value can quickly diminish as this date nears.

Difference between spot trading and options trading

The main difference between spot trading and options trading is that in spot trading, you own the asset you’re trading, whereas in options trading, you hold a contract that grants you the right to buy or sell an underlying asset at a future date.