In today’s digital world, the way we pay has completely transformed. Gone are the days when you had to carry a bulky wallet full of plastic cards. Now, you can shop, subscribe, and spend online with just a few taps — thanks to virtual cards.

But with both virtual cards and physical cards available, which one is actually better when it comes to international payments?

If you’ve ever wondered this, you’re not alone. In this article, we’ll break it down clearly and simply — so you can choose the best option for your needs.

Spoiler alert: By the end, you’ll see why thousands of people in Nigeria and Ghana are switching to virtual USD cards on Astro Africa to shop and pay internationally.

What Is a Virtual Card?

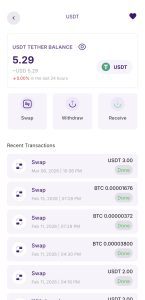

A virtual card is a card that exists only in digital form.

It has a card number, CVV, and expiry date — just like a regular card.

But there’s no physical plastic.

You use it mainly for online payments and app subscriptions.

You can generate a virtual card in seconds on platforms like Astro Africa — and start using it to pay on:

Amazon

AliExpress

Apple, shein, Google Play

Netflix

Spotify

Facebook ads

Many international website

What Is a Physical Card?

A physical card is the traditional plastic card you get from your bank or card issuer.

👉 You can hold it in your hand.

👉 You can swipe or insert it at POS machines.

👉 You can also use it online (but it exposes your real bank details).

Examples: Your Naira Mastercard, Visa card, USD bank card, etc.

How to Sell USDT in Nigeria and Get Paid Instantly (2026 Guide)

In 2026, USDT has become the go-to cryptocurrency for Nigerians. Whether you’re a freelancer receiving payments from international clients, a trader taking profits, or someone

5 High‑Demand Digital Skills Ghanaians Can Learn for Free & Start Earning Online in 2025

In 2025, digital skills have become one of the fastest ways for Ghanaians to earn income without needing a degree or heavy capital. Whether you’re

Google Play Card Showing “Need More Info to Redeem”? Here’s How to Fix It Fast

When you buy a Google Play gift card, you expect it to work smoothly. But sometimes, instead of seeing your balance update, you get this

Key Differences Between Virtual and Physical Cards

| Feature | Virtual Card | Physical Card |

|---|---|---|

| Format | Digital only | Plastic |

| Use case | Online payments | Online & in-person |

| Security | High — masked from bank account | Lower — linked to real bank account |

| Speed of creation | Instant | Days to weeks |

| Cost | Low to free | Often annual fee |

| Risk of fraud | Very low | Medium-high |

| Replacement | Instant | Days/weeks |

| Suitable for international payments | Very high | Often limited, sometimes blocked |

| Currency options | USD, EUR, GBP, others | Mostly local currency unless USD card |

Why Virtual Cards Win for International Payments

Now, let’s get to the heart of it: which is better for international payments?

Here are the key reasons why a virtual card is usually the smarter choice:

1. Avoid Bank Restrictions

In Nigeria and Ghana, many banks place limits on how much you can spend internationally with a Naira card. Some even block certain sites (like Netflix or Facebook ads).

Virtual USD cards on Astro Africa bypass these restrictions. You can spend freely in dollars without issue.

2. Better Security

When you use a physical card online, you expose your real bank card details. If it gets compromised, your entire account is at risk.

With a virtual card, you’re protected:

✅ It’s a separate card not linked to your main bank.

✅ You can freeze or delete the card instantly.

✅ You can create a fresh card anytime.

3. Control & Flexibility

👉 Set spending limits.

👉 Use separate cards for different services (Netflix on one, Amazon on another).

👉 Pause or delete cards you no longer need.

This level of control simply isn’t possible with physical bank cards.

4. No Waiting, No Branches

With Astro Africa, you can create a virtual card in under 2 minutes.

No branch visits.

No paperwork.

No card delivery delays.

Compare this to waiting 2-3 weeks for a physical USD card from a bank!

5. Great for Subscriptions & Ads

If you run Facebook ads, Google ads, or subscribe to services like Canva, Shopify, Netflix — virtual USD cards are the perfect tool.

✅ Pay in USD, avoid currency conversion fees.

✅ Avoid Naira card restrictions.

✅ Easy to manage business payments.

When Is a Physical Card Better?

Of course, physical cards still have their uses:

👉 For in-person shopping where only POS machines are accepted.

👉 For cash withdrawals at ATMs (though you’ll often get poor rates on foreign withdrawals).

👉 For people who prefer to manage fewer cards.

tip: Many Astro Africa users maintain a local Naira card for local POS use and a virtual USD card for online & international use. Best of both worlds!

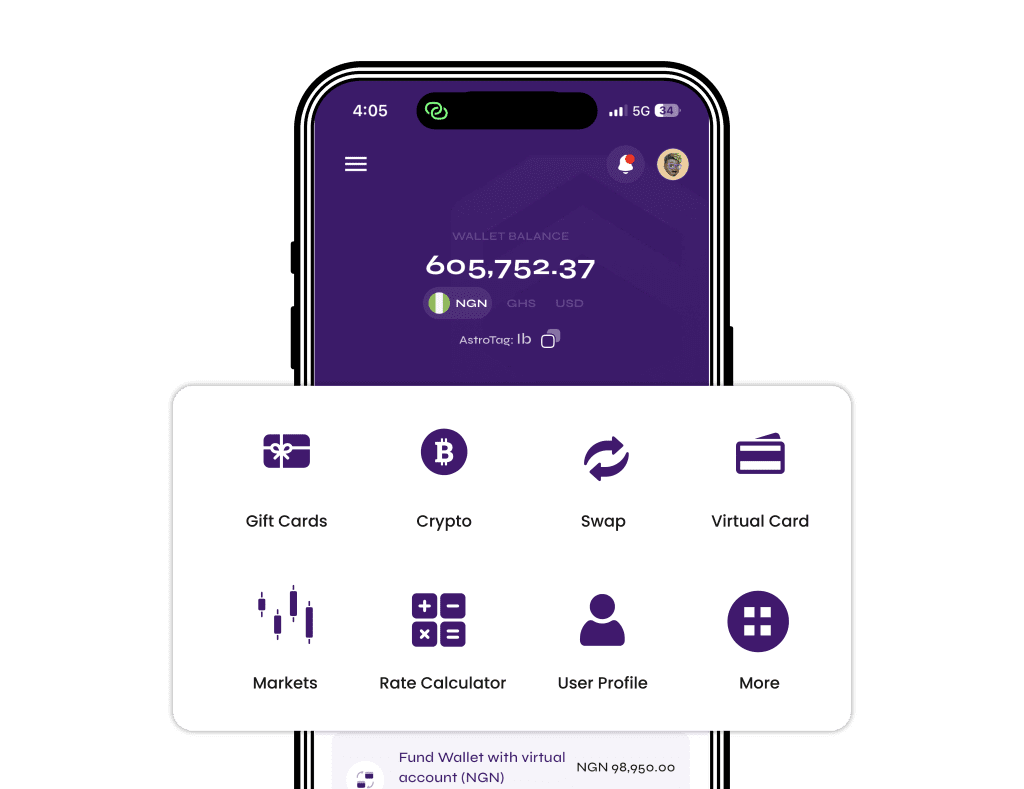

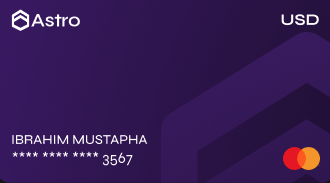

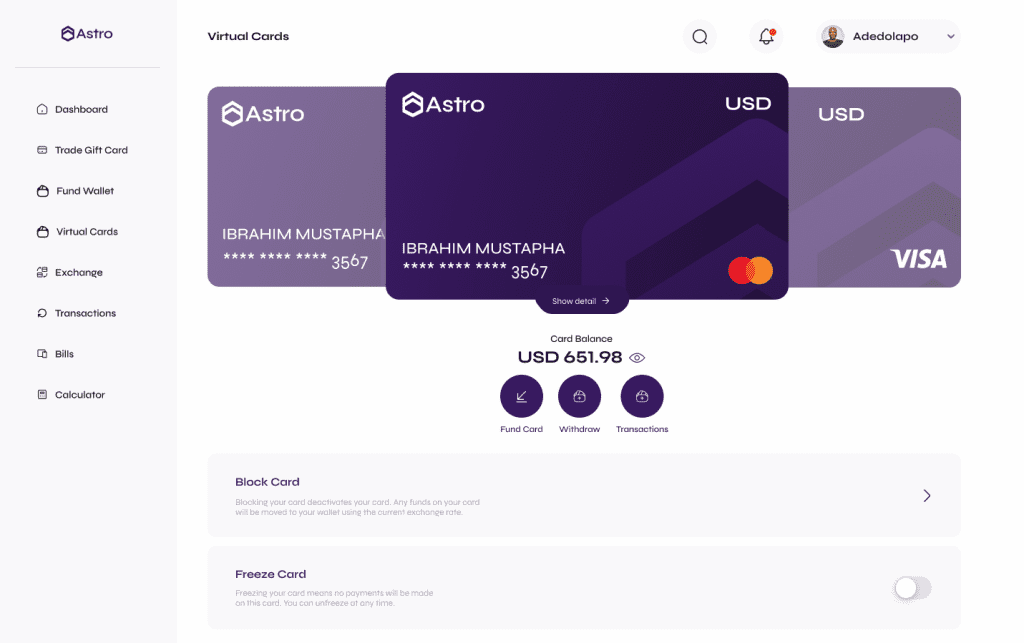

Astro Africa Virtual USD Card: The Perfect Tool for International Payments

With Astro Africa virtual USD cards, you can:

✅ Pay online globally

✅ Avoid Naira card limits

✅ Manage subscriptions easily

✅ Fund your card instantly via the app

✅ Pause or delete your card anytime

✅ Get great rates and transparent fees

✅ Withdraw unspent funds back to your bank

It’s trusted by thousands of Nigerians and Ghanaians looking for seamless international payment solutions.

FAQs: Virtual Card vs Physical Card

1. Can I use a virtual card in-store?

Usually no — virtual cards are for online use. Some apps allow adding them to mobile wallets like Apple Pay, but this depends on the issuer.

2. Are virtual cards safe?

Yes — in fact, they’re safer for online payments because they isolate your bank account from the transaction.

3. Can I create multiple virtual cards?

With Astro Africa — yes! You can generate multiple cards and manage them easily.

4. Can I pay for Facebook & Google ads with a virtual USD card?

100% yes — this is one of the top use cases for Astro Africa cards.

5. How fast can I get a virtual card?

Instantly — you can generate and fund your card in minutes via the Astro Africa app.

Final Verdict: Which Should You Choose?

For international payments — a virtual USD card is clearly the better choice.

✅ More secure

✅ No bank restrictions

✅ Faster setup

✅ Flexible & easy to manage

For local POS and ATM use — keep a physical card for convenience.

Smart users combine both tools — but for anyone paying online or internationally, a virtual card is a game changer.