Running a small business in Nigeria is not a small feat — from managing inventory to growing sales and balancing daily operations. But one crucial responsibility every serious business owner must handle is filing taxes.

Whether you’re a freelancer, vendor, or full-time entrepreneur, the government expects you to pay your taxes and file returns — and doing this right can protect you from penalties, build your business credibility, and even position you for loans or grants.

In this guide, we’ll break down how to file taxes as a small business owner in Nigeria, what documents you need, how to stay compliant, and tools you can use to make it all easier.

Why Do Small Business Owners in Nigeria Need to File Taxes?

Here’s why you can’t ignore taxes:

✅ It’s a legal requirement — the FIRS and your state tax board expect annual tax returns.

✅ You avoid fines, interests, and shutdowns.

✅ It helps you apply for government funding, loans, and contracts.

✅ It improves your financial records and business reputation.

If you want to build a sustainable business, taxes are part of the game.

Types of Taxes Small Business Owners Must File

Here are the most common taxes that may apply to your small business:

1. Personal Income Tax (PIT)

If you’re a sole proprietor, your business profits are taxed as personal income.

2. Company Income Tax (CIT)

For registered limited liability companies, 30% of profits are taxed (though small companies with turnover below ₦25 million are exempt).

3. Value Added Tax (VAT)

If your annual turnover is above ₦25 million, you’re expected to collect 7.5% VAT on sales and remit it to FIRS monthly.

4. Pay-As-You-Earn (PAYE)

If you have employees, you must deduct their income tax and remit it on their behalf monthly.

Step-by-Step: How to File Taxes as a Small Business in Nigeria

Let’s break it down so even a first-timer can understand.

✅ Step 1: Register with FIRS and Your State Tax Authority

Visit the FIRS office or register online at firs.gov.ng.

You’ll receive a Tax Identification Number (TIN).

Also register with your State Internal Revenue Service (like LIRS for Lagos).

✅ Step 2: Keep Good Business Records

Start tracking your:

Daily sales and income

Expenses and operational costs

Salaries and staff records

Assets and bank statements

Tools like Excel, bookkeeping apps, or accounting software can help.

✅ Step 3: Calculate Your Taxable Income

If you’re a sole proprietor, this is your total income minus your business expenses.

If you’re running a registered company, your net profit is taxed (after allowable deductions).

✅ Step 4: File Annual Returns

For individuals and sole proprietors:

File with your State tax board.

For limited companies:

File with the FIRS using the company’s audited financials.

🗓️ Returns are typically due by June 30th every year.

✅ Step 5: Remit Monthly Taxes (VAT, PAYE, etc.)

If applicable:

Remit VAT by the 21st of every month.

Remit PAYE (employee taxes) to your state revenue board monthly.

Tools & Platforms That Can Help

✅ TaxPro Max – FIRS official e-filing portal

✅ TIN Verification Portal

✅ Professional tax consultants (for larger businesses)

Benefits of Filing Your Taxes Properly

✨ Peace of mind — no fear of surprise audits or fines

✨ Access to government contracts, grants, and corporate partnerships

✨ Builds trust with banks, investors, and stakeholders

✨ Keeps your business in good legal standing

FAQ – Filing Taxes in Nigeria

Q1: I run a small business from home. Do I still need to pay tax?

Yes — once you’re earning income from goods or services, tax laws apply.

Q2: Can I file taxes myself without an accountant?

Yes — especially as a sole proprietor. But if things get complex, a tax consultant can help.

Q3: What happens if I don’t file my taxes?

You could face penalties, interest on owed tax, or even account restrictions from government action.

Q4: I’m just starting. Do I need to register with FIRS immediately?

Yes — once you start business activity, register to get your TIN.

Q5: Can I file taxes online?

Yes — use TaxPro Max for company filings, and check your state IRS site for individual returns.

Final Thoughts

If you’re running a small business in Nigeria, filing your taxes isn’t optional — it’s a smart, necessary move for long-term success.

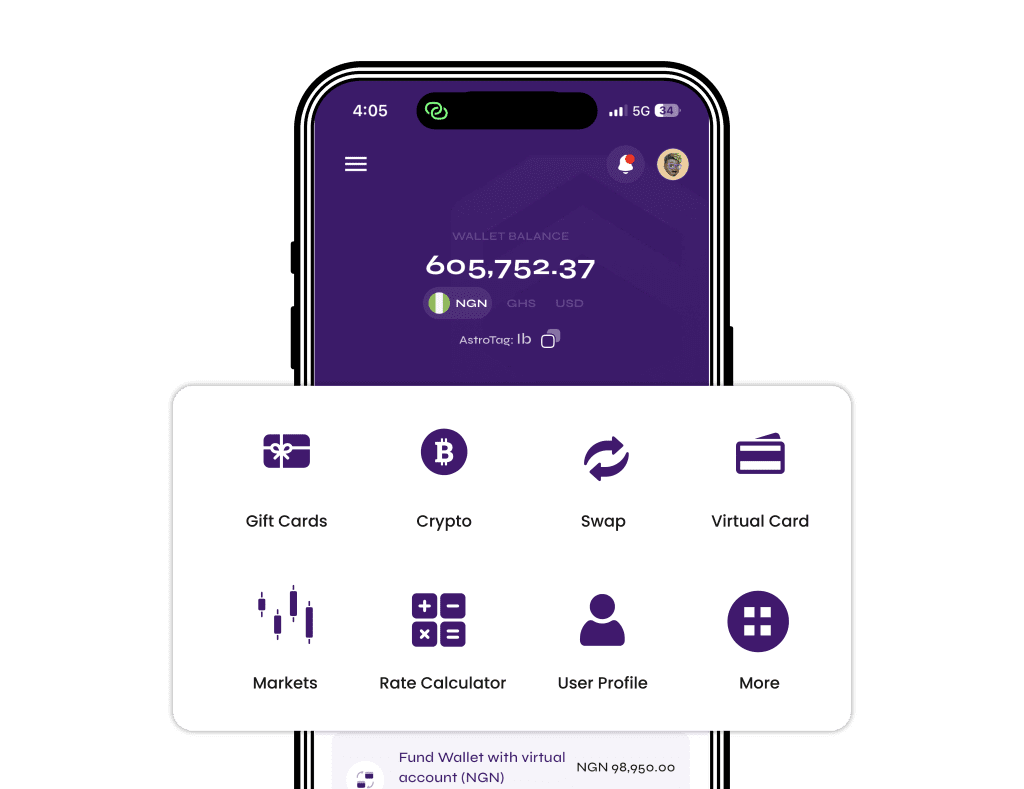

And just like Astro Africa makes it easy to sell gift cards, crypto, and access virtual cards — staying tax-compliant makes your business future-proof.

✅ Start today:

Register for your TIN

Track your income and expenses

File on time

Stay organized

With love,

Astro Africa 💚