Let’s face it — financial discipline is not easy.

Between jollof cravings, weekend parties, betting temptations, and Instagram soft life pressure, saving money in Nigeria or Ghana can feel like an extreme sport.

But here’s the truth: your money habits today will determine your freedom tomorrow.

If you’re tired of being broke two days after payday, these 10 growth hacks will help you become more financially disciplined — and still enjoy your life.

10. Pay Yourself First (Even Before Paying Rent)

This is the golden rule of money.

The moment you earn, set aside a fixed percentage (10–30%) before doing anything else. Call it “soft life tax” for your future self.

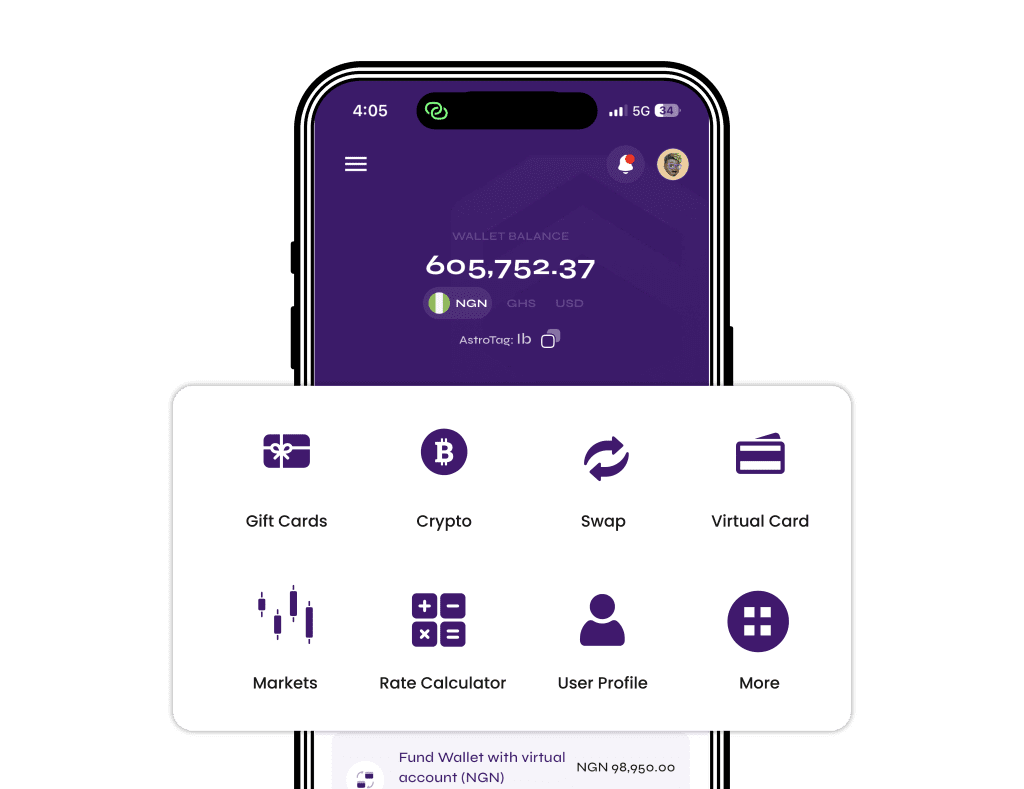

You can keep it in a separate savings app, a stablecoin wallet like USDT, or even on Astro Africa — where you can later swap to Naira or Cedis when you’re ready to use it.

📌 Discipline starts with priority.

9. Use the “Two-Week Delay” Rule

Impulse spending is a money killer. That random ₦85,000 sneaker you saw? Wait 2 weeks.

If you still want it after 14 days and can afford it without touching your savings — then go ahead. Most times, you’ll forget it.

The richer you want to be, the longer you should learn to wait.

8. Track Every Kobo or Pesewa You Spend (For 30 Days)

You can’t improve what you don’t measure.

Use apps like Spending Tracker, Monify, or even Google Sheets. At the end of each week, review your expenses.

You’ll be shocked at how much you’re losing to shawarma, bolt rides, and subscriptions you forgot about.

Awareness leads to adjustment.

7. Automate Your Savings or Investment

Don’t trust your willpower. It’s not strong enough. Trust automation instead.

Set up recurring transfers to a savings platform, or buy USDT or Bitcoin every month (you can later sell or swap it on Astro Africa if you need funds).

Discipline becomes easier when it’s not a daily decision.

6. Have a ‘No-Spend Day’ Every Week

Choose 1 or 2 days weekly where you spend ₦0 or GHC0.

No food delivery. No airtime. No random buying.

You’ll realize you don’t need half the things you normally spend on.

Silence your inner spender — one day at a time.

5. Unfollow Lifestyle Pressure

That influencer who posts designer every day but never shows their real hustle?

Mute all of them.

You don’t need that pressure.

Focus on content that educates, inspires, or teaches how to grow your money — not just spend it.

Protect your mental wallet too.

4. Rename Your Bank Accounts

Instead of naming your savings account “Access Bank 2”, name it:

“My First Land 2026”

“Canada Plan 💼”

“No More Broke January”

You’ll be less tempted to touch it when it has a mission.

The brain responds to intention — use it to your advantage.

3. Avoid Peer Pressure Purchases

If your friends always say:

“Let’s split this ₦300k table, na only once.”

Just smile and say: “I’m not doing that chapter of my life again.”

You don’t have to match anyone’s lifestyle. Stay focused on your own lane.

Money discipline is unpopular — until it pays off.

2. Reward Yourself (Intelligently)

Being disciplined doesn’t mean being miserable.

Set milestones:

“If I save ₦100k this month, I’ll buy myself that ₦8k wristwatch.”

Small rewards keep your brain motivated without blowing your budget.

Progress should feel good — not painful.

1. Learn Every Day About Money

You’re already here reading Astro Africa’s blog — that’s a solid first step.

Financial literacy isn’t taught in schools. But online? You can learn everything:

How to save in USD

How to sell crypto safely

How to grow money with gift cards

And how to avoid being scammed

The more you know, the better you grow.