Looking for a stress-free way to grow your money in Nigeria without trading daily or checking charts all the time?

Then mutual funds might be exactly what you need.

In this guide, we’ll break down what mutual funds are, how they work in Nigeria, the different types, how to invest, the risks, and everything in between — all in simple, human language.

💡 What Is a Mutual Fund?

A mutual fund is a pool of money collected from many investors (like you) to invest in assets like:

Stocks

Bonds

Treasury bills

Real estate

Commodities

Professional fund managers handle the investment decisions, so you don’t need to be an expert. You just invest and watch your money grow.

How Do Mutual Funds Work in Nigeria?

Let’s say 1,000 Nigerians each invest ₦10,000 in a mutual fund. That’s ₦10,000,000 combined.

The fund manager uses that pooled money to invest in diverse assets like stocks, bonds, or government securities.

At the end of each period (usually monthly or quarterly):

Profits (or losses) are shared among investors based on their contribution.

You can also decide to withdraw or reinvest your returns.

Mutual funds are regulated by the Securities and Exchange Commission (SEC) in Nigeria, making them a safer and more transparent option for beginners.

Benefits of Investing in Mutual Funds in Nigeria

✅ Professional Management – Experts handle the investment for you.

✅ Diversification – Your money is spread across multiple investments, reducing risk.

✅ Low Entry Requirement – Some funds start from as low as ₦5,000.

✅ Liquidity – You can withdraw your money relatively quickly.

✅ Passive Income – Great for people with full-time jobs or businesses.

Types of Mutual Funds in Nigeria

| Type of Mutual Fund | What It Invests In | Risk Level |

|---|---|---|

| Equity Funds | Company shares (stocks) | High |

| Fixed Income Funds | Bonds, treasury bills | Low |

| Balanced Funds | Mix of stocks and bonds | Medium |

| Money Market Funds | Short-term govt securities, bank deposits | Very Low |

| Real Estate Funds | Property and infrastructure | Medium |

| Ethical/Shariah Funds | Investments aligned with religious laws | Varies |

Top Mutual Fund Providers in Nigeria (2025)

These are trusted names offering mutual fund services in Nigeria:

Stanbic IBTC Asset Management

ARM Investment Managers

FBNQuest Asset Management

Meristem Wealth

Chapel Hill Denham

United Capital Asset Management

Cordros Asset Management

Afrinvest

Vetiva Fund Managers

Each provider has different fund options based on your goals and risk appetite.

How to Invest in Mutual Funds in Nigeria (Step-by-Step)

Set Your Financial Goal

Are you investing for long-term wealth, school fees, a house, or retirement?Choose a Mutual Fund Type

E.g., Money Market for low risk or Equity Funds for high returns.Select a Provider

Visit their website or office (e.g., Stanbic IBTC or FBNQuest).Complete Registration

Submit your ID, BVN, utility bill, and fill out a risk assessment form.Fund Your Investment

Start with as low as ₦5,000 or ₦10,000 depending on the provider.Track Your Investment

Most funds send monthly updates or provide mobile apps for tracking.

What Are the Risks of Mutual Funds?

Like any investment, mutual funds carry some level of risk.

Stock-based funds may fall in value during a market crash.

You might earn less than expected if the market underperforms.

Some funds have management fees that reduce your profit.

But compared to trading forex or crypto on your own, mutual funds are much safer — especially when you pick the right one.

Tips Before You Invest

Always read the fund factsheet to understand where your money goes.

Check past performance, but remember it’s not a guarantee of future results.

Consider the fund manager’s reputation and experience.

Start small and increase as you learn more.

Final Thoughts

Mutual funds are one of the most underrated ways to build wealth in Nigeria. They offer peace of mind, professional management, and a solid return — all without you lifting a finger.

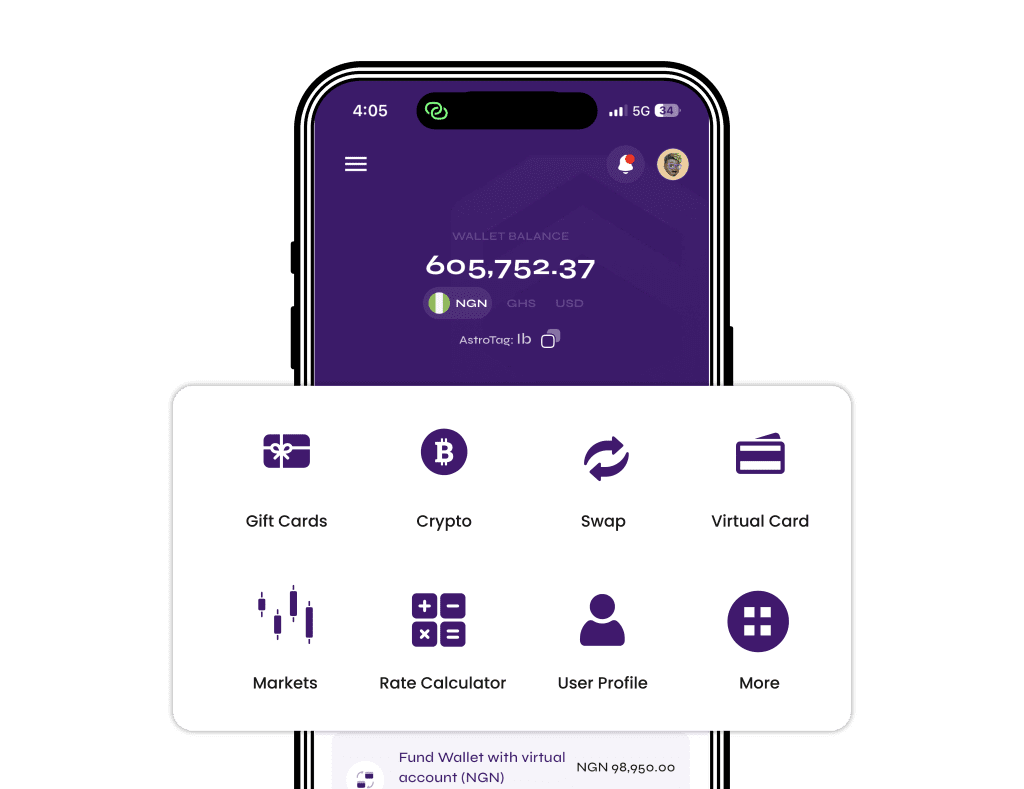

If you want to diversify your financial journey beyond crypto, gift cards, or virtual cards, mutual funds are a smart move.

And remember: Building wealth is a marathon, not a sprint.