Filing taxes in Nigeria can feel overwhelming for small business owners — especially with all the paperwork, deadlines, and government requirements. But the truth is: once you understand the basics, it becomes easy to stay compliant, avoid penalties, and keep your business legit.

Whether you run a physical shop, offer services online, or operate a registered business name, here’s a detailed, beginner-friendly guide to help you file your taxes correctly in Nigeria.

Do Small Business Owners Need to Pay Tax in Nigeria?

Yes — whether you’re a sole proprietor, freelancer, digital entrepreneur, trader, or artisan, you’re required by law to pay tax if your income exceeds a certain threshold.

There are two main types of tax small business owners in Nigeria should be aware of:

Personal Income Tax (PIT)

Company Income Tax (CIT) — if you’re registered as a Limited Liability Company (LLC)

Let’s break them down.

1. Personal Income Tax (PIT)

If you operate as a sole trader or freelancer, you’re expected to pay Personal Income Tax to your State Internal Revenue Service (IRS).

What You Need:

Your Tax Identification Number (TIN)

Proof of business income (bank statements, invoices, etc.)

Access to your state’s IRS portal (e.g., LIRS for Lagos)

How to File:

Register your business (if you haven’t)

Get your TIN from the nearest FIRS or state IRS office or online.

Calculate your annual income

Apply the graduated tax rate (7%–24% depending on income level)

File your annual returns using your state IRS portal or manually via a tax consultant.

2. Company Income Tax (CIT)

If your business is registered as a Limited Liability Company, you’re required to pay Company Income Tax to the Federal Inland Revenue Service (FIRS).

What You Need:

CAC registration documents

Tax Identification Number (TIN)

Audited financial statements

FIRS e-filing account

How to File:

Log in to the FIRS TaxPro Max portal – https://taxpromax.firs.gov.ng

Upload your financials and file returns.

Calculate and pay:

20% tax for small companies earning less than ₦100M annually

30% tax for large companies

You must also file VAT returns, even if you didn’t charge VAT that month (zero returns are still required).

When Are Tax Returns Due in Nigeria?

Annual PIT returns: Due March 31st every year

CIT returns: Due six months after your company’s accounting year-end

VAT & Withholding Tax: Due on the 21st of every month

Late filing leads to penalties, which is why staying organized and filing early is key.

How to Get Your TIN (Tax Identification Number)

Your TIN is your tax identity — just like your BVN for banking. To get one:

For Individuals:

Visit your State IRS or apply via the Joint Tax Board portal:

👉 https://tin.jtb.gov.ng

For Businesses:

Visit any FIRS office with your CAC certificate and valid ID.

Best Practices for Filing Taxes as a Small Business Owner

Keep good records – Track all income, expenses, receipts, and invoices.

Separate personal and business accounts – Helps during audits or reviews.

Work with an accountant if your finances are complex.

Always file, even if you didn’t make a profit. It shows you’re active and avoids penalties.

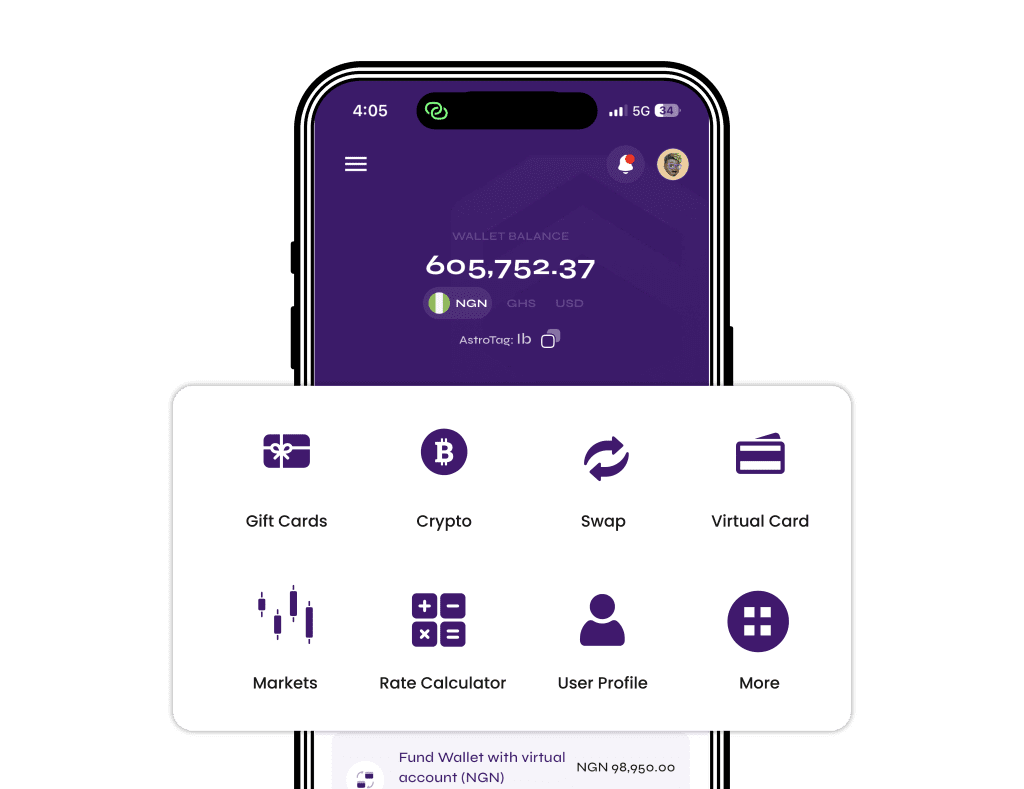

Use digital tools – apps like QuickBooks, Excel, or even a simple notebook help you stay on track.

Why It Matters

Filing taxes is not just about compliance — it builds credibility. Whether you’re applying for a business loan, foreign payment gateway, or government grant, having clean tax records can help you get approved faster.

Being a small business owner in Nigeria isn’t easy, but tax doesn’t have to be a burden. The more you understand the system, the easier it is to stay ahead.

If you run a side hustle, digital gig, or crypto business, it’s time to formalize your income and take control of your finances.