Living in Nigeria comes with its fair share of expenses—some expected, many surprising. Whether you’re a student trying to stretch your allowance, a young professional balancing bills, or a business owner looking to optimize spending, saving money on everyday expenses is more important than ever.

The good news? You don’t need a miracle. You just need strategy. Here’s how to cut costs, keep more naira in your pocket, and start building a better financial life.

1. Track Everything You Spend

The first step to saving is knowing where your money goes. Use budgeting apps or a simple notebook to track food, transport, data, bills, and “unplanned” buys. You’ll be shocked at how the little things eat into your budget.

Tip: At the end of the month, review your expenses. Cut the non-essentials and set limits going forward.

2. Buy in Bulk

Retail prices in Nigeria are inflated. If you can, buy groceries and household essentials in bulk from wholesalers or open markets. It saves you money long-term and reduces the need for frequent trips.

Example: A pack of spaghetti in a supermarket might cost ₦900, but ₦700 when you buy a full carton.

3. Use Public Transport or Carpool

Fuel prices and ride-hailing services like Bolt and Uber can drain your account if used daily. If it’s safe and possible, use buses, BRTs, or carpool with friends. It might not be flashy, but your wallet will thank you.

4. Limit Eating Out

Eating out in Lagos or Abuja can feel like burning money. Try to cook more at home, even if it’s just basic meals. Meal prepping over the weekend also saves time during busy weekdays.

You don’t need to be a chef — just consistent enough to avoid daily food vendor temptation.

5. Use Cashback & Discount Platforms

Look for apps and platforms that offer cashback, discounts, or loyalty points. They’re rare in Nigeria but growing. Some fintechs also offer better rates when you spend in USD or top up through them.

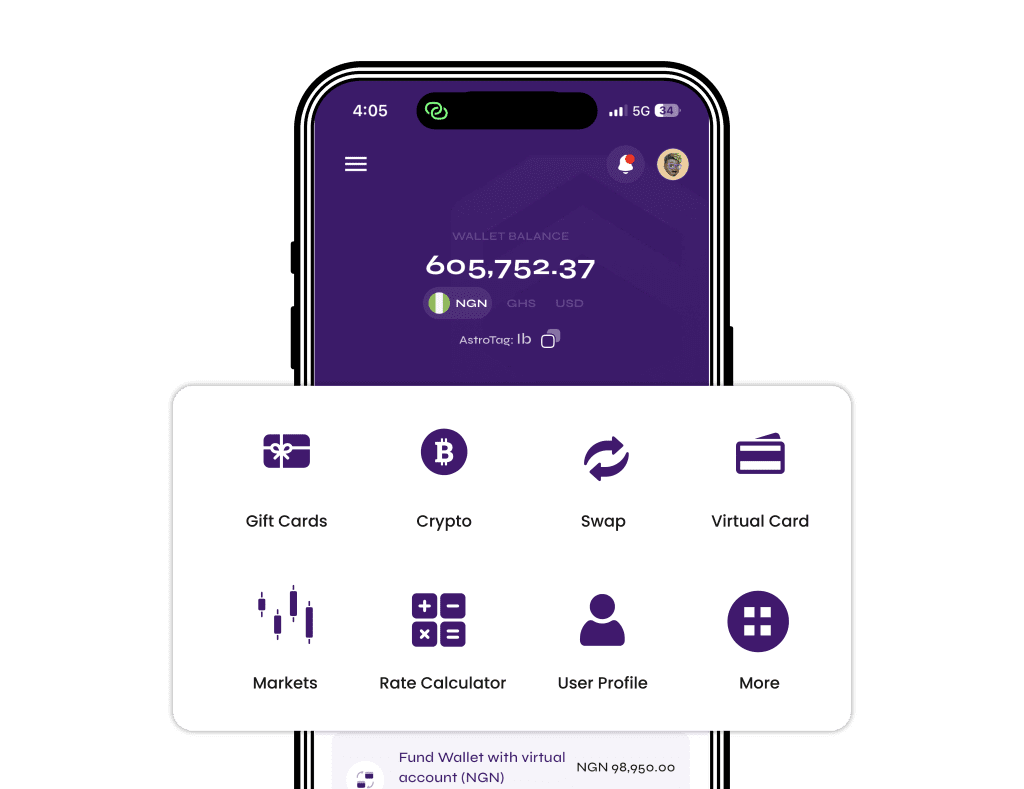

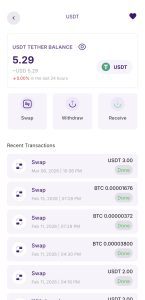

6. Swap Foreign Currency Smartly

If you receive foreign currency, don’t just use random exchangers. Use platforms like Astro Africa to swap USD, Cedis, or other currencies to Naira securely and get competitive rates. Every extra naira counts.

7. Cancel Auto-Renewals You Don’t Use

You subscribed to a streaming service, forgot about it, and it’s been deducting for 6 months. Sounds familiar?

Go through your bank debits and cancel subscriptions you don’t actively use.

8. Buy Generic or Local Brands

You don’t need imported cereal or skincare to live well. Support Nigerian brands or go for affordable alternatives. They often work just as well without the international markup.

9. Learn Basic Repairs

Plumbing, electricals, tailoring — learn the basics or find reliable, affordable technicians. You’ll avoid overpaying for minor issues.

10. Avoid Buy Now, Regret Later

Impulse buying is a budget killer. Always give yourself 24 hours before making a non-essential purchase. If you still want it the next day, maybe it’s worth it. But chances are — you’ll move on.

Saving In Nigeria Is Survival

Inflation is real. But you can fight back with smarter daily choices. Whether it’s switching how you commute, where you shop, or how you swap currencies — every small decision adds up to big savings.