Want to start forex trading in Nigeria or Ghana in 2025—but not sure where to begin?

Forex trading is booming in Africa. In Nigeria and Ghana alone, retail forex trading has grown by over 30% year-on-year, fueled by mobile access and financial education. But knowing where to start is the key to success.

This guide gives you a full step‑by‑step plan to start forex trading in Nigeria and Ghana in 2025—from choosing the right broker and setting up an MT5 demo account, to placing your first trade and managing risk like a pro. It’s built for beginners who want real results, not hype.

Table of Contents

Understand Forex Trading Basics

Choose a Secure, Regulated Broker

Open and Fund a Trading Account (Demo → Live)

Download and Setup MetaTrader 5 (MT5)

Learn Basic Trading Concepts

Create Your First Forex Trade

Master Risk Management and Leverage

Track and Improve with a Trading Journal

Transition to Live Trading in Nigeria & Ghana

FAQs & Next Steps

1. Understand Forex Trading Basics

Forex (forex trading market) is simply the buying and selling of currency pairs like USD/NGN or EUR/GHS. It runs 24/5 and is the largest financial market in the world

Key terms:

Pip: Smallest price movement

Lot: Trade size unit

Leverage: Borrowed capital to amplify trading power

Spread: Broker’s fee difference between buy and sell prices

Understanding these fundamentals sets you up for smart trading.

2. Choose a Secure, Regulated Broker

Selecting the right broker is critical:

Must be regulated (e.g., FCA, CySEC, or local CBN regulation in Nigeria)

Offers low spreads, fast execution, and Naira/Cedi funding options

Provides 24/7 customer support

Top picks for beginners in Nigeria & Ghana: Exness, XM, and IC Markets — all offer low deposits and demo accounts.

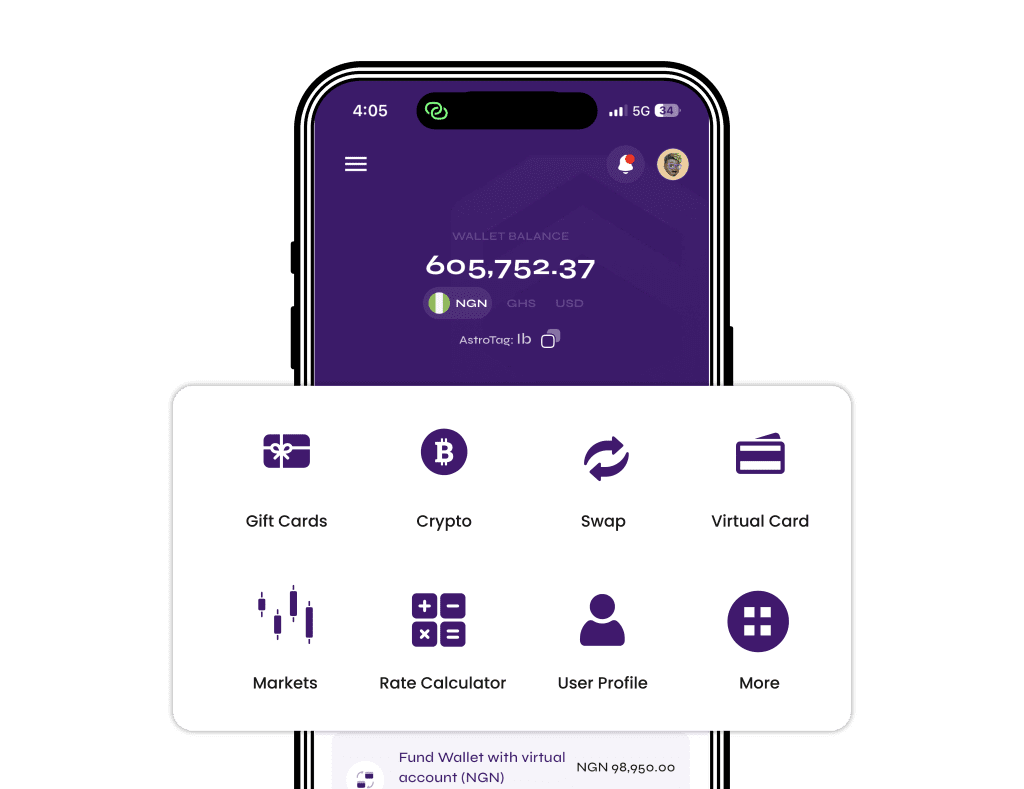

3. Open and Fund a Trading Account

Choose broker and register online

Verify your identity using ID and proof of address

Open a demo account to practice

When ready, fund a live account (min. $100)—you can use bank transfer, debit card, or even crypto

4. Download and Setup MetaTrader 5 (MT5)

Install MT5 desktop or mobile app

Login using your broker-provided credentials

Explore charts, indicators, and trade execution tools

MT5 is beginner-friendly with advanced capabilities—ideal for scalability

5. Learn Basic Trading Concepts

Technical Analysis: Use tools like price action, trend lines, RSI, MACD

Fundamental Analysis: Monitor economic indicators, interest rates, and GDP data

Candlestick Patterns: Learn reversal signals like Doji and Hammer

Combine analysis methods for better entries and exits.

6. Create Your First Forex Trade

Pick a currency pair (e.g., EUR/USD, GBP/USD, USD/NGN)

Determine position size (start small, eg. 0.01 lots)

Set Stop-Loss and Take-Profit levels

Choose Buy or Sell based on analysis

Review your trade regularly and close if your goals or conditions are met

7. Master Risk Management and Leverage

Risk only 1–2% of your capital per trade

Use stop-loss to limit downside

Start with low leverage, then scale as you gain confidence

Keep an eye on economic news—pins your trade early and closes safely

8. Track and Improve with a Trading Journal

Maintain a journal with:

Date, pair, size

Entry & exit points

Rationale behind trades

Outcome & lessons learned

Consistent tracking leads to improvement over time.

9. Transition to Live Trading in Nigeria & Ghana

Begin with small live trades using real capital after demo success

Gradually increase position size as you see consistent results

Always keep learning and adjusting

Use local economic events (e.g., CBN or GCB interest decisions) to guide trades

10. Read also

5 Common Mistakes To Avoid When Selling Crypto in Nigeria & Ghana

How to Earn Passive Income with Crypto Staking

What Is The Best App To Sell Litecoin In Nigeria?

FAQs:

How to start forex trading in Nigeria and Ghana 2025 step by step?

Follow this guide—choose a regulated broker, open demo → live accounts, use MT5, track your trades, and manage risk with proper leverage.

What is the best demo account platform for Forex beginners in Ghana?

The widely recommended platform is MetaTrader 5 (MT5) offered by brokers like Exness and XM—it’s easy to use and covers technical tools for beginners.

Can I fund my forex account in Nigeria with Naira and trade on MT5?

Yes. Brokers like Exness and XM accept NGN via bank transfer or debit cards and offer seamless integration with MT5.

How much money do I need to start forex trading in Ghana?

You can start with as little as $100, which equals about ₵1,000–₵1,200 depending on current FX rates.

What risk management strategies should I use as a new forex trader in Nigeria?

Always risk no more than 1–2% per trade, use stop-loss orders, and manage leverage carefully to maximize longevity and protect capital.

Conclusion

Starting forex trading in Nigeria and Ghana in 2025 is entirely achievable—if you follow a clear, step-by-step strategy:

Learn the basics

Use MT5 demo

Formulate a risk-managed plan

Scale up gradually

By using trusted brokers like Exness or XM, and tools like MT5, you can trade confidently, profitably, and sustainably.