Many people of you would wonder, why compare Bitcoin vs Gold? But have you ever heard of Bitcoin being called Digital Gold? That need has caused investors to start the debate around Bitcoin and Gold’s profitability. The conversation needed to be had because Bitcoin has also been compared with the dollar, real estate, and several other investment vehicles. So, it is only natural for Bitcoin to be compared to Gold.

If you have been in tune with the times as an investor, you would understand the need for Gold and Bitcoin in your investment portfolio. It is the smartest thing you can do for yourself and your investments because you never know when the next recession will occur. For a minute, let’s reminisce about the great recession of the 2000s and how we thought it would be the last, and then COVID-19 happened, taking the whole world by surprise.

Although the COVID recession period was short, it had so many impacts on the economics of several countries in the world, especially Africa. Other recessions have occurred since then, raising several questions about what an investment portfolio should look like with new investment vehicles introduced daily.

In the past decades, if you wanted to succeed as an investor, it was advised to hold most of your investments in precious metals like Gold because it gives you a competitive advantage when stocks take a nosedive in economic downtime. The story is quite different now with innovations in financial technology that birthed cryptocurrencies like Bitcoin. Since the inception of Bitcoin, despite the bear markets, the digital currency has continuously proven to investors to be a profitable investment.

Here, in this article, you’ll learn all about Bitcoin and Gold as we compare them based on some investment parameters.

Bitcoin

Bitcoin launched in 2009—the decentralized technology ushered in a new era in finance and investing. Initially, these digital currencies were only attractive to a few niche enthusiasts. In 2010, early speculators discovered the Bitcoins they had previously purchased for fractions of a cent had grown to $0.09 per Bitcoin. Large-scale Bitcoin mining farms and pools became popular, and cryptocurrency exchanges emerged. After the COVID-19 pandemic in 2021, the price of Bitcoin soared above $60,000. However, the value has since been reduced due to Bitcoin’s volatility.

Read also: Current bitcoin rate in naira

Gold

Nearly every developed culture throughout history has used Gold as a source of monetary exchange or a symbol of prosperity. Humans have been recovering Gold from riverbanks, veins, and ore deposits on every continent (except Antarctica) for thousands of years. Humans continue to attach importance to Gold as a profitable asset due to its durability, malleability, cross-functionality, and aesthetics.

Comparing Bitcoin and Gold

Bitcoin vs Gold: Regulation

Gold is highly regulated in many countries. That is why you cannot cross the borders of some countries carrying a ridiculous amount of Gold without being questioned by the authorities. This level of regulation is also observed with Bitcoin in several countries, especially in some African countries where it has been banned.

Bitcoin vs. Gold: Liquidity

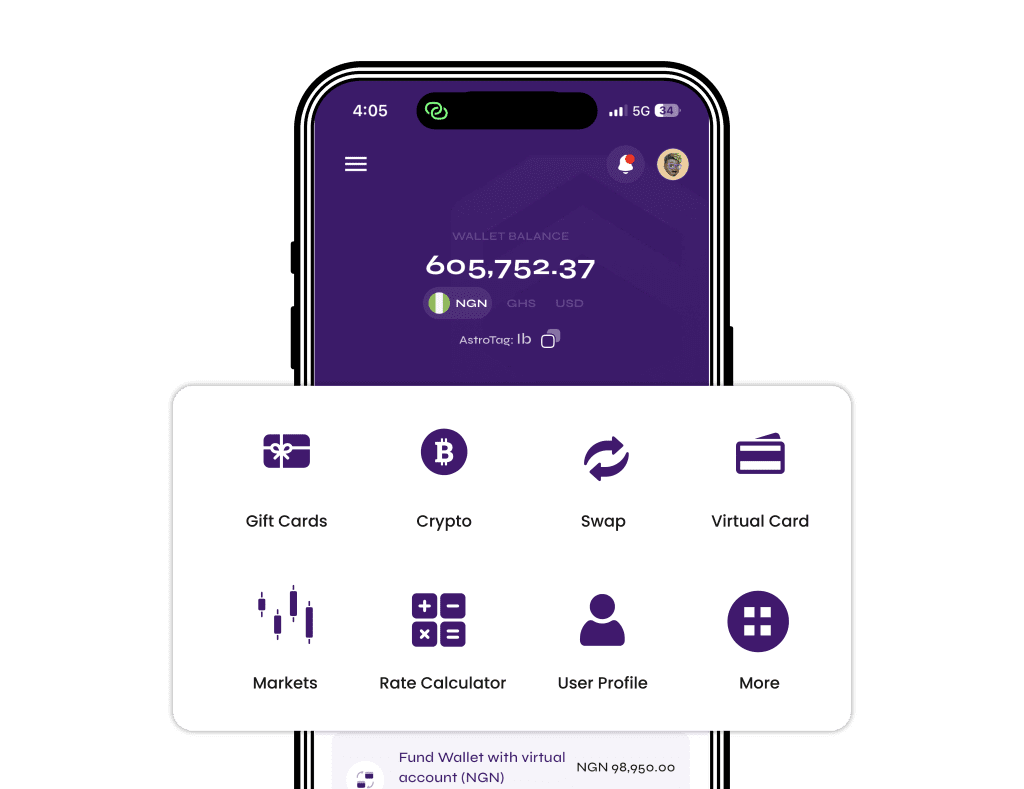

Gold is a frequently traded asset, so finding a buyer is easier than finding a buyer for Bitcoin. This provides Gold with higher liquidity than Bitcoin. Bitcoin also has high liquidity thanks to apps like Astro Africa, which make trading easy and seamless.

Bitcoin vs. Gold: Volatility

The value of Bitcoin is subject to sentiments, media hype, influencer influence, and regulations. This makes the value of Bitcoin more volatile than Gold. Hence, Gold wins this parameter since it hardly ever declines in value except for severe inflation.

Bitcoin vs. Gold: Use cases

The use of Gold has a historical backing that is well-known to man. It has been used as a means of exchange, creating machines, Jewelries, dentistry and a host of other functions. The wide use cases of Gold have given it an edge over investment vehicles by maintaining its value over time.

Conversely, Bitcoin has limited utility and has only been truly used as a digital currency and speculative investment. However, through defi, the utility of Bitcoin has increased by being used in lending, borrowing, and more.

Bitcoin vs. Gold: Longevity

We have seen many investment opportunities come and go without leaving a trace of the commotion they caused because people relied on them. It is why you must question the longevity of investment vehicles when questioning their viability. Asking if Gold will live long will be trying to erase history because Gold has existed for over 5000 and is still waxing strong.

On the other hand, Bitcoin might have some questionable characteristics since it is a currency we cannot see, but we’ve been convinced beyond reasonable doubt that it exists. We’ve seen several crypto projects come and go, so it’s only right to question how long Bitcoin will last. Bitcoin has a great competitive advantage over other cryptocurrencies by being the most successful crypto and has been around the longest to prove that it truly works.

How to sell Bitcoin for Naira and Cedis

Astro Africa is the best platform to sell Bitcoin for naira and cedis, thanks to its easy user interface and swift transactions. To sell Bitcoin on Astro Africa, create an account using your email and phone number and proceed to start trading Bitcoin for money.