As inflation and currency volatility continue to affect economies worldwide, Ghanaians have begun exploring innovative financial solutions to protect their wealth. One such solution gaining popularity is USDT (Tether), a stablecoin that offers a hedge against the declining value of the Ghanaian cedi. Stablecoins like USDT are pegged to stable assets such as the US dollar, providing a more reliable store of value compared to fiat currencies like the cedi, which are subject to inflation and devaluation.

This article explores why Ghanaians are increasingly turning to USDT and how stablecoins provide a financial safety net in uncertain economic times.

What is USDT (Tether)?

USDT (Tether) is a type of cryptocurrency known as a stablecoin. Unlike Bitcoin or Ethereum, whose prices fluctuate based on market demand, USDT is pegged to the US dollar on a 1:1 ratio, meaning that 1 USDT is always equal to 1 USD. The main advantage of USDT is its stability; it retains its value regardless of market conditions, making it a safer option for those looking to protect their assets from inflation or currency volatility.

Because USDT is backed by real-world assets and is widely accepted on various cryptocurrency platforms, it offers Ghanaians a secure and stable means of storing and transferring value.

See also: Where to sell USDT for cedis at the highest rates

Why Are Ghanaians Turning to USDT?

Hedge against currency devaluation

One of the primary reasons Ghanaians are turning to USDT is to hedge against the ongoing depreciation of the cedi. When the value of the cedi drops, individuals holding USDT are insulated from this depreciation since the value of USDT remains stable in relation to the US dollar. This allows Ghanaians to store their wealth in USDT, reducing the impact of cedi devaluation and preserving their purchasing power.

By holding USDT, Ghanaians can protect their savings and wealth from the negative effects of inflation and currency fluctuations. Instead of seeing the value of their assets erode in cedis, they can maintain the value of their savings by holding a stablecoin.

Stable medium of exchange

For those engaging in international trade or remittances, USDT offers a more reliable medium of exchange compared to the cedi. Due to the volatility of the local currency, international traders often prefer to transact in a stable currency like USDT to avoid exchange rate risks.

Furthermore, Ghanaians working abroad or receiving remittances from family members often choose to receive payments in USDT rather than in cedis, ensuring that their funds are not affected by currency depreciation during the transfer process.

Access to global markets

USDT also gives Ghanaians access to the global cryptocurrency market, allowing them to participate in trading and investing without being limited by the fluctuations of their local currency. By holding USDT, individuals can easily trade it for other cryptocurrencies or fiat currencies on global platforms, making it a versatile asset.

This global accessibility allows Ghanaians to diversify their portfolios, invest in foreign assets, and take advantage of economic opportunities outside of Ghana’s borders without worrying about the instability of their national currency.

Low transaction fees

Another reason USDT is becoming popular in Ghana is its low transaction fees. Sending money or making transactions in USDT is generally cheaper than traditional banking methods or international wire transfers. Ghanaians can transfer USDT between wallets or to exchanges with minimal fees, making it an attractive option for both individuals and businesses.

Stability in times of crisis

The appeal of USDT also lies in its ability to act as a safe haven during economic or political instability. When local markets face uncertainty or crisis, holding USDT can offer financial security. In times of hyperinflation or drastic currency devaluation, the value of stablecoins like USDT remains unaffected, allowing people to weather financial storms more effectively.

How Ghanaians are using USDT

Ghanaians are using USDT in various ways, including:

Saving: Many individuals store their wealth in USDT to protect against inflation and currency depreciation.

Trading: Traders use USDT as a stable base currency to buy and sell other cryptocurrencies on exchanges.

Remittances: Families and workers abroad send remittances back to Ghana in USDT to avoid the volatility of the cedi.

Payments: Some businesses and individuals are starting to accept USDT for goods and services, providing a more stable form of payment.

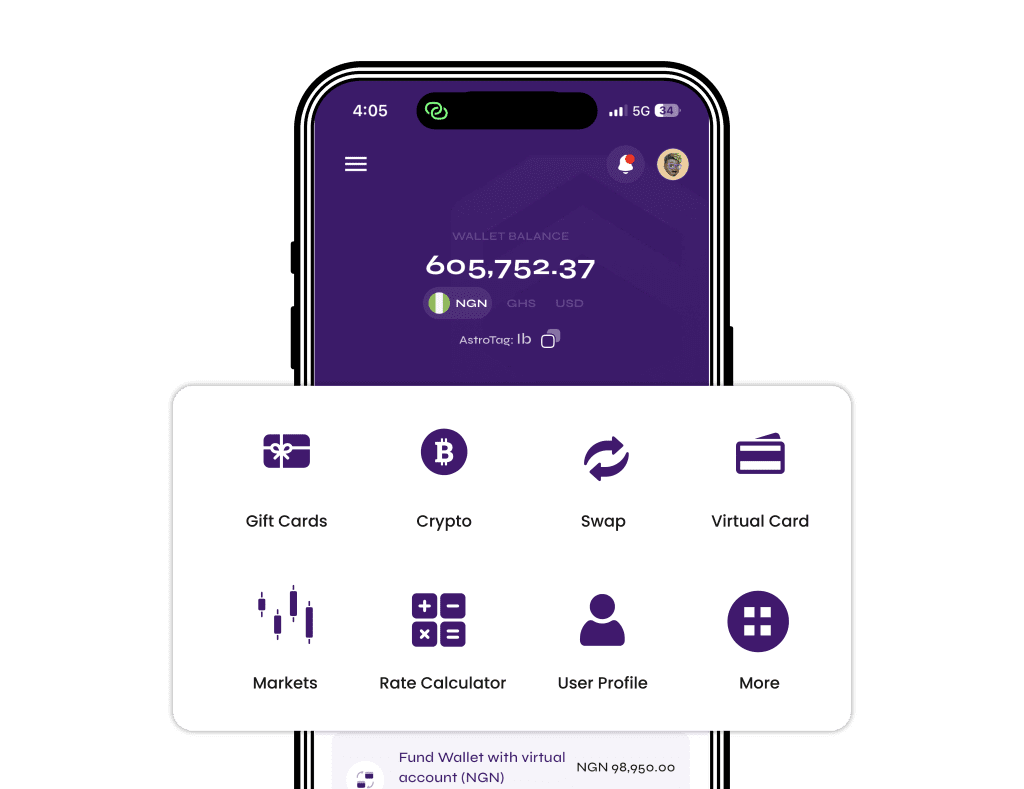

The Role of Platforms Like Astro Africa

Platforms like Astro Africa make it easy for Ghanaians to buy, sell, and trade USDT securely. Astro Africa provides a user-friendly platform that allows individuals to convert their cedis into USDT and vice versa, ensuring that Ghanaians can hedge against currency fluctuations with ease. By using Astro Africa, Ghanaians can also access other cryptocurrencies, manage their digital assets, and protect their wealth from inflation.