Want to Save in Dollars? Here’s the Smartest Way to Do It from Nigeria

The Naira is unpredictable. Inflation is high. Prices keep going up.

If you’re earning in Naira and saving in Naira, you’re fighting a losing battle.

That’s why more Nigerians are switching to USD savings. It’s not just smart—it’s survival. And now, thanks to platforms like Astro Africa, saving in USD is easier than ever. No foreign account needed. No dollar notes. Just your phone and your Astro wallet.

In this guide, we’ll show you exactly how to start saving in USD in Nigeria, how to fund your dollar wallet with Naira or crypto, and how to secure your money without stress.

Why You Should Save in USD as a Nigerian

Let’s face the facts:

The Naira has lost over 60% of its value in the last 5 years

Inflation in Nigeria keeps rising (food, rent, fuel…)

Import costs and forex scarcity affect everything

But if you saved in USD, your money retains value—and even grows if the Naira falls further.

Here’s what saving in USD protects you from:

Loss of purchasing power

Unstable Naira-to-dollar exchange rates

Sudden government policies or naira limitations

With USD savings, you stay one step ahead.

Best Way to Save in USD from Nigeria: Astro Africa Wallet

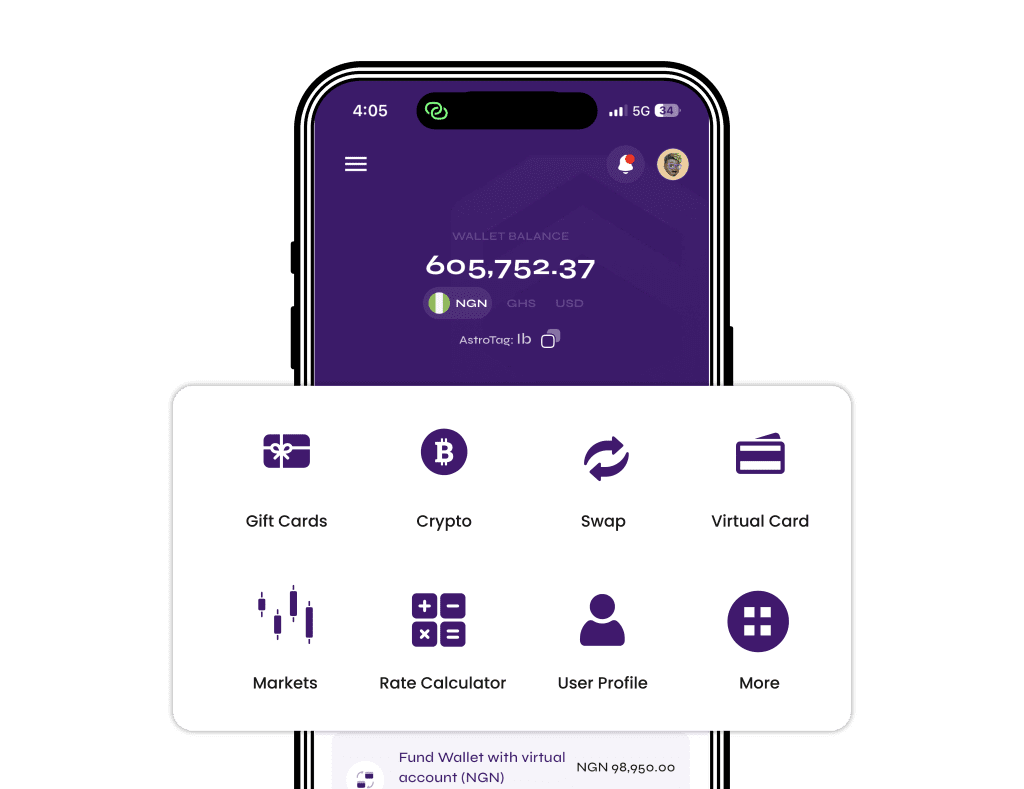

Astro Africa makes it possible to:

Swap your Naira to USD instantly

Store your USD securely in a digital wallet

Fund your wallet using Naira, Cedis, crypto, or gift cards

Create a virtual dollar card for spending globally

You don’t need a foreign bank account or dollar cash.

Everything is done digitally, within minutes.

Read also:

How to File Taxes as a Small Business Owner in Nigeria

Step-by-Step Guide: How To Start Saving in USD in Nigeria

Step 1: Create a Free Astro Africa Account

Visit app.astroafrica.site

Sign up with your email and phone number

Verify your identity (KYC takes just minutes)

Step 2: Fund Your Wallet

There are four ways to fund your wallet:

Directly with Naira via bank transfer

Sell gift cards (Amazon, iTunes, etc.) for USD

Sell crypto like BTC, ETH, or USDT

Swap Cedis or other currencies to USD

Once funded, your balance will reflect instantly in your local currency wallet.

Step 3: Swap Naira to USD

Go to “Swap Currency”

Select Naira to USD

Enter amount

Review exchange rate

Confirm the transaction

Within seconds, your USD wallet is funded and you’re now saving in dollars.

Benefits of Saving in USD with Astro Africa

✅ Protection from inflation

✅ No hidden fees

✅ Real-time exchange rates

✅ Flexible funding options (crypto, Naira, cards)

✅ Option to withdraw, convert or spend USD anytime

It’s more than saving—it’s building a financial shield.

How to Withdraw or Use Your USD

Once you’ve built up your USD savings, Astro Africa allows you to:

Convert USD back to Naira and withdraw to any Nigerian bank

Use your USD to create a virtual card and shop online

Send USD to others instantly

This is not just a savings wallet. It’s a full USD ecosystem.

Read also:

How To Get Paid For Watching Videos Online (Legit Ways That Actually Work in Nigeria)

Tips to Build Strong USD Savings from Nigeria

Set a monthly target (e.g., save ₦50,000 worth of USD every month)

Sell unused gift cards and flip the money into USD

Convert part of your freelance or side hustle earnings

Use Astro’s swap feature when rates are favorable

Avoid impulsive conversions back to Naira

FAQ – Saving in USD in Nigeria with Astro Africa

Q1: Is saving in USD legal in Nigeria?

A: Yes. Astro Africa operates legally and allows Nigerians to save in USD digitally through swaps and wallet services.

Q2: What is the minimum amount I can save in USD?

A: There’s no minimum. You can start with as little as ₦1,000 and convert it to dollars.

Q3: Where is my USD stored?

A: Your funds are stored securely in your Astro Africa USD wallet, accessible 24/7.

Q4: Can I spend directly from my USD wallet?

A: Yes. You can use your USD balance to fund a virtual card or convert it back to Naira.

Q5: Are there any fees?

A: Exchange rates are fair and transparent. You only pay for what you convert.

conclusion

Inflation won’t wait.

The Naira isn’t slowing down.

But you don’t have to lose value anymore.

With Astro Africa, you can start saving in USD today—directly from Nigeria—without stress, restrictions, or a foreign bank.

Your savings will thank you later.

Ready to protect your money?

Start saving in USD now on Astro Africa.